| | In today’s edition: Dubai-based telecom eyes frontier markets riches and Mubadala Capital to acquire͏ ͏ ͏ ͏ ͏ ͏ |

| |  | | | Global Capital Edition |

| |

|

- Mining frontier markets

- Outdoor ads fetch $6.2B

- VC surge in the Gulf

- Lower oil: not a problem

The limit to luxury travel spending: $7,700 a night. |

|

When US President Donald Trump met with Gulf leaders last year, collecting trillion-dollar investment pledges, sovereign wealth bosses in the region had their own ask: Make it easier for them to buy US firms. The stumbling block has been the Committee on Foreign Investment in the United States, which has oversight on the sale of US assets. Gulf sovereigns (and other investors) have complained that the process takes too long and that it can be difficult to decipher how decisions are made. Gulf funds have stepped up the pace of their investments and the US is a top destination, but they don’t like sitting and waiting for months for a deal to be approved. Or, doing a deal and then being forced to exit it later, as Saudi Aramco’s venture capital firm had to do in 2023 after initially buying a stake in a Sam Altman-backed AI chip startup. The US Treasury Department is now working to formalize creation of a Known Investor Program, giving big repeat investors access to a fast track for deal approvals. Yasir Al-Rumayyan, the governor of Saudi Arabia’s Public Investment Fund, said last year that it could invest much more in the US but that it was hampered from doing so. “I hope with the current administration, these restrictions will be out,” he said. He may be about to get his wish. |

|

Dubai’s VEON chases frontier markets |

@VEONGroup/X @VEONGroup/XVEON, the Nasdaq-listed telecom and digital services group run from Dubai, wants to emulate Berkshire Hathaway, its CEO Kaan Terzioglu told Semafor. The company operates in fast-growing but underserved countries including Bangladesh, Pakistan, and Ukraine, reaching about 200 million customers. VEON generates roughly $4.4 billion in annual revenue. While it’s still dominated by telecoms, digital services such as payments and entertainment are growing quickly and could reach half of revenue within three years: In Pakistan, VEON’s payments platform processes transactions equivalent to about 13% of GDP. This expansion gives Terzioglu the confidence to make the comparison to the world’s most successful conglomerate. “We will eventually become a consumer and enterprise services company, which happens to have a telecom license,” Terzioglu said in an interview. “We are very proud to be… the Berkshire Hathaway of frontier markets.” — Mohammed Sergie |

|

Mubadala Capital to buy US billboards |

Courtesy of Clear Channel Outdoor Courtesy of Clear Channel OutdoorAbu Dhabi’s Mubadala Capital will acquire US-listed Clear Channel Outdoor in a deal that values the advertising company at $6.2 billion. Mubadala Capital is partnering with TWG Global on the deal to take over the billboard company, which has been under pressure from activist investor Anson Funds Management to sell itself. The all-cash offer values Clear Channel stock at a 71% premium to the share price before media reports revealed in October that talks were underway. TWG acquired a minority stake in Mubadala Capital last year as part of a plan to increase cooperation between the two investors and get access to more opportunities. Mubadala Capital was launched by the Abu Dhabi sovereign wealth fund Mubadala about 15 years ago to manage third-party capital. It now has assets under management of about $30 billion and last month raised $554 million for its first co-investment fund, surpassing its initial target, in the latest sign of growing investor appetite for exposure to the firm’s deal flow. — Matthew Martin |

|

Venture capital accelerates |

The amount invested into startups in the Middle East and North Africa last month — more than triple what was raised in December 2025 — and led by two megadeals in the UAE: Islamic digital bank Mal’s $230 million deal and Property Finder’s $170 million round, according to data from startup analytics platform Wamda. Qatar, meanwhile, is emerging as the fastest-growing market after Qatar Investment Authority announced this month that it will triple a program backing VC firms in Doha to $3 billion. Venture backing for startups in Qatar has risen about 80% over the past year, albeit from a low base. The government aims to foster new companies focused on deep tech, materials science, food security, and energy. |

|

Gulf builds up economic resilience |

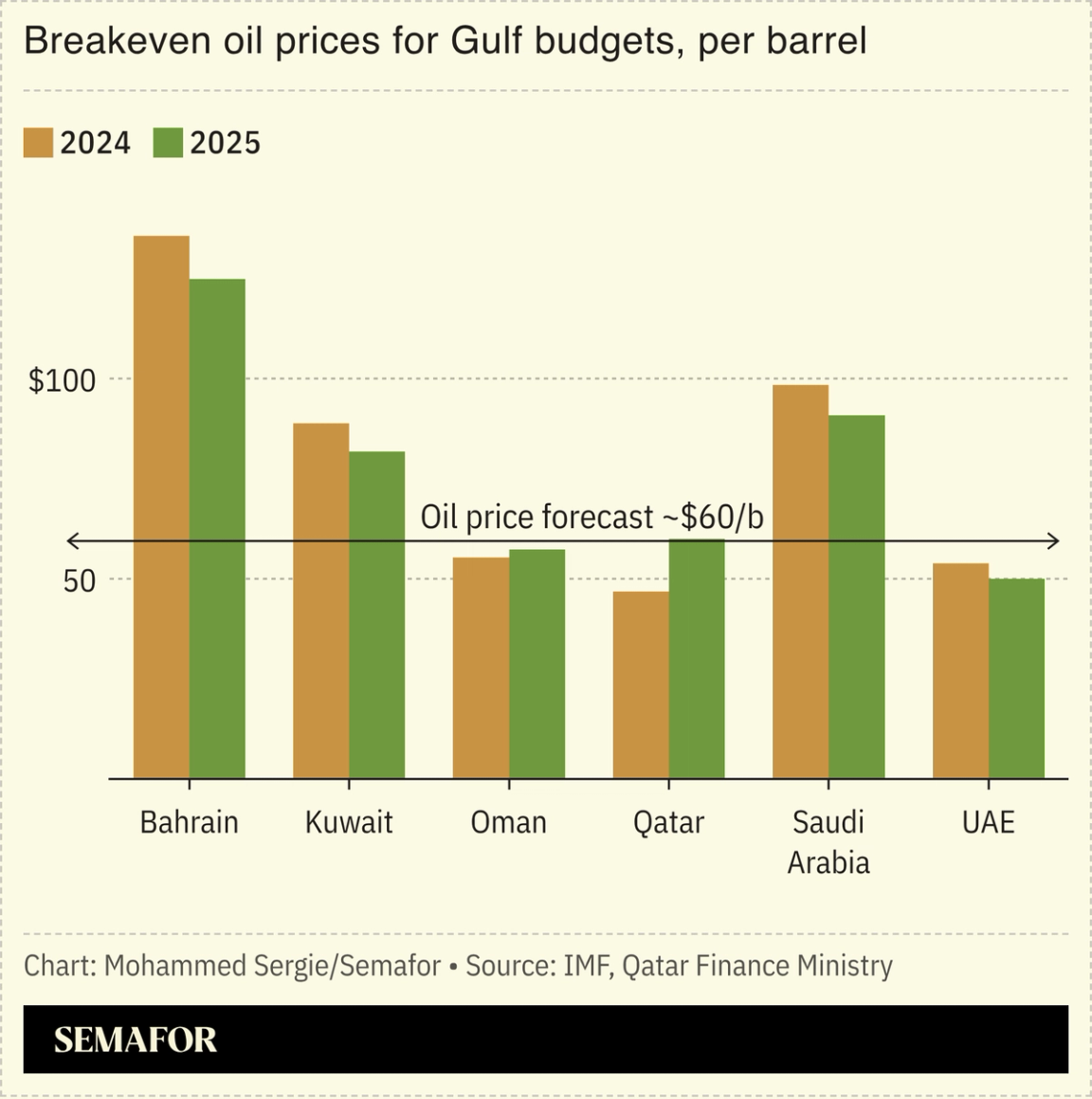

Oil prices may be soft, and geopolitical tensions high, but Gulf economies are more resilient than in the past. In a new report, S&P Global Ratings said it expected economic growth across the Middle East to average around 3.4% this year, helped by higher oil and gas output and strong non-oil activity, particularly in Saudi Arabia and the UAE. Most governments have fairly strong balance sheets, and the expansion of their tax bases in recent years — with the introduction of corporate income taxes, sales tax, and higher excise duties on tobacco and sugary drinks — means they can more easily protect themselves against external pressures. S&P said the outlook for sovereign credit across the region this year was stable. That’s good news for governments that will need to sell bonds to cover their outgoings — the agency’s forecast average oil price of $60 a barrel this year is below what many countries need to balance their budgets. The ratings agency also expects foreign direct investment into the region to remain weak, meaning the onus on paying for economic diversification will rest firmly with Gulf governments themselves. — Dominic Dudley |

|

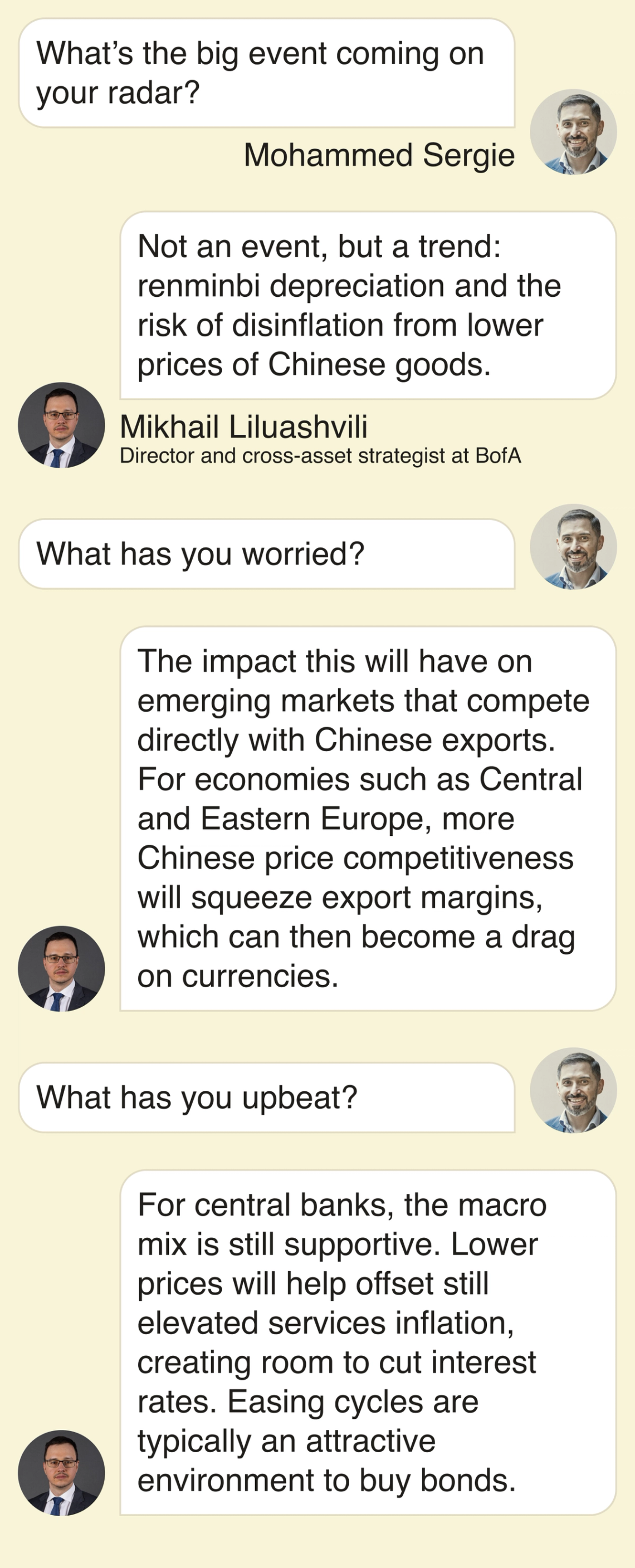

Every week, we ask a different expert what they’re focused on. Today, we’re talking to Mikhail Liluashvili, a Director and cross-asset strategist focusing on Eastern Europe, Middle East, and Africa fixed income and FX at Bank of America.  |

|

A rendering of Aman’s Amangati yacht. @amanatsea/Instagram. A rendering of Aman’s Amangati yacht. @amanatsea/Instagram.Luxury travel is testing the wealthy’s spending limits. Aman Group has opened bookings for its first yacht under the Aman at Sea brand, created in partnership with PIF-owned Cruise Saudi, which sets sail next year. Securing a spot in one of the 47 suites costs a minimum of $7,700 per day, with prices for larger suites pushing closer to $30,000 a night. Few have booked, so far, according to Bloomberg. Where the upper limits of tourism are set will inform pricing in the Gulf. Saudi Arabia has Red Sea resorts costing thousands of dollars a night, Oman has built remote glamping mountain lodges, and the UAE is expanding its glitzy offering, all chasing the world’s highest spenders. |

|

| |