| | In today’s edition: Saudi’s HUMAIN launches a sports AI unit and Qatar is on an LNG tanker buying sp͏ ͏ ͏ ͏ ͏ ͏ |

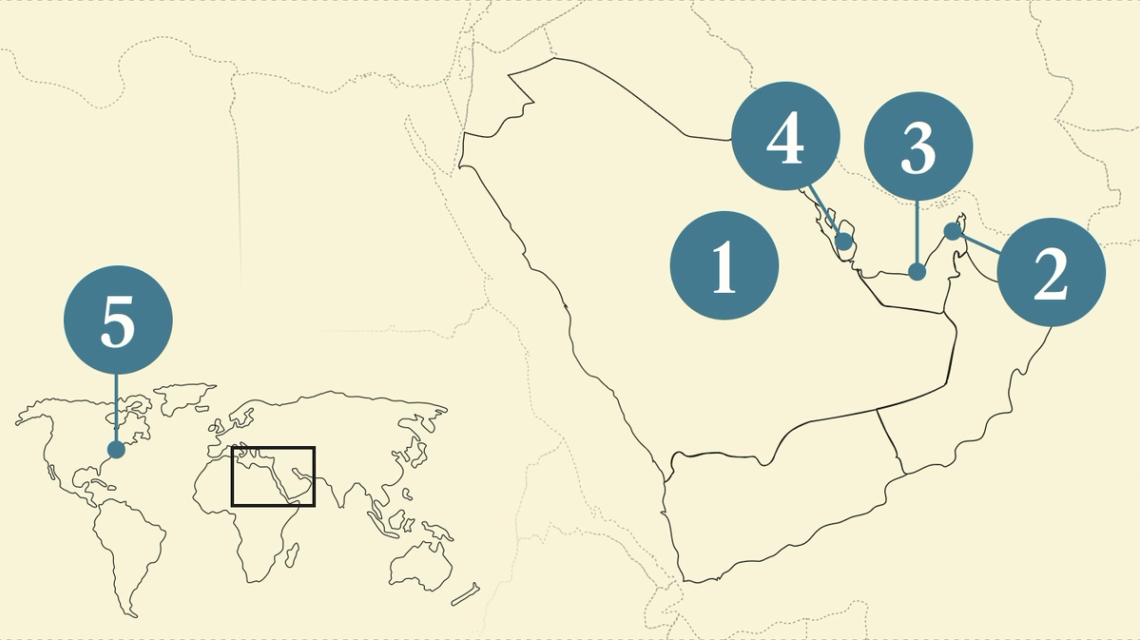

| |   Ras Al Khaimah Ras Al Khaimah |   Doha Doha |   Riyadh Riyadh |

| Gulf |  |

| |

|

- Saudi’s ‘AI for sports’ play

- RAK casino lures buyers

- Abu Dhabi buys Dubai land

- Qatar expands LNG fleet

- Gulf tapped for school funds

Five years of images from the UAE’s Mars probe. |

|

In 2017, Jeffrey Epstein tried to insert himself into the Saudi-led embargo of Qatar, organizing a meeting between (former) Qatari and Israeli leaders to help end the rift. Today, from beyond the grave, Epstein is back in Gulf politics, his emails fueling the latest feud between Saudi Arabia and the UAE. Epstein spent decades circling Gulf elites, occasionally cracking the top tier but never gaining the confidence of those who truly command the region’s staggering wealth. He wasn’t the first hustler trying to break through, and won’t be the last. Since the Gulf struck oil, dubious middlemen have plied their trade in oil and arms deals, engineering kickbacks, hanging out in Monaco casinos, and procuring women. Some of this is immortalized in books and court cases, but rarely have we seen the grasping, calculating details as glimpsed through Epstein’s emails. A network linking American, European, and Middle Eastern elites is spawning theories crediting Epstein with an outsize role in geopolitical breakthroughs like the Abraham Accords that he couldn’t have orchestrated. But proximity leaves a residue. And one of Epstein’s acquaintances — Sultan Ahmed bin Sulayem, the CEO and chairman of Dubai ports giant DP World — has found himself at the center of the crisis. Beyond the vulgarities is an accusation that is inflaming Muslim passions: Epstein appears to have been in possession of a piece of the Kiswah, the cloth that covers the Kaaba. There isn’t a definitive trail in the emails, yet, that verifies authenticity of the assertion, but the cloth looks close enough to the real thing that it’s been weaponized online, with accusations that the UAE supplied one of Islam’s holiest artifacts to a sex offender. An image of Epstein showing the cloth to bin Sulayem is being used as proof that the UAE’s elites are hostile not just to political Islam or the Palestinian cause, but to the religion itself. (DP World and bin Sulayem haven’t commented on the reports.) As Semafor’s Ben Smith put it, the Epstein emails are an oil slick that won’t wash off — and this may even hold true in a region where scandals are contained by closing ranks. On Tuesday, after a detailed exposé by Bloomberg, Canada’s second-largest pension fund — which has invested more than $5 billion alongside DP World over the past decade — said it is suspending future investments until DP World sheds “light on the situation and takes the necessary actions.” Epstein never achieved his ambition of being a top Gulf power broker. In death, he’s having a major impact. |

|

Saudi’s HUMAIN invests in sports AI |

Tareq Amin. Hamad I Mohammed/Reuters. Tareq Amin. Hamad I Mohammed/Reuters.Saudi Arabia’s artificial intelligence champion HUMAIN acquired a controlling stake in London-based ai.oi, as it looks to build new business lines. The UK company uses motion capture and AI to scout for sporting talent, and monitor and suggest improvements for athletes’ performance — technology that will now be channeled into the new HUMAIN Sport platform. The terms of the investment were not disclosed. The investment was announced at an event in Riyadh where HUMAIN Chief Executive Tareq Amin also offered a glimpse of an operating system the Public Investment Fund-backed firm has developed that runs AI models to improve workflows — part of a suite of AI-fueled products it aims to launch. The ai.oi deal is the second investment announced by HUMAIN since its launch last year, when it backed Luma AI’s $900 million fundraise. The US company is now planning to open a Riyadh office. — Matthew Martin |

|

Aerial rendering of the Mina master plan in Ras Al Khaimah. Courtesy of RAK Properties. Aerial rendering of the Mina master plan in Ras Al Khaimah. Courtesy of RAK Properties.Plans for the Gulf’s first casino, in the once-sleepy emirate of Ras Al Khaimah, have been a boon for RAK Properties, a luxury developer which is looking to open its first international sales office in the UK, its CEO told Semafor. British buyers, as well as Indians and Russians, helped RAK Properties more than double its sales last year to 3.4 billion dirhams ($910 million). The developer is partially owned by the government of Ras Al Khaimah, which holds a 34% stake and has allocated large swaths of prime coastal real estate to the firm. The emirate — best known as a major ceramics producer — is poised for a boom when the Wynn Al Marjan resort opens in 2027, becoming the Gulf’s first destination for legal gambling. RAK Properties is targeting 25% annual growth in revenue, profits, and project delivery in the next five years, CEO Sameh Muhtadi said. It has branding tie-ups with the Four Seasons hotel group and Armani, and plans to deliver nearly 2,000 units by the end of 2026. Part of the pitch to prospective buyers: Expect to fetch a high rental premium from vacationers. — Kelsey Warner |

|

Abu Dhabi’s Aldar builds Dubai homes |

The number of new homes Aldar, Abu Dhabi’s largest listed developer, and Dubai Holding plan to build in Dubai under an expanded joint venture. The next phase of the partnership, which was launched in 2023, will add two projects with a combined value of more than $10 billion. One is a family-oriented community, due to launch in 2026; the other is a luxury waterfront development on Palm Jebel Ali, scheduled to launch in 2027. The projects fit in with Dubai’s long-term plan to expand housing options and create new districts beyond the city’s current core, the companies said in a release. The expansion comes as Aldar reported record sales for the past year and a 36% jump in profits, amid strong demand for real estate across the UAE. |

|

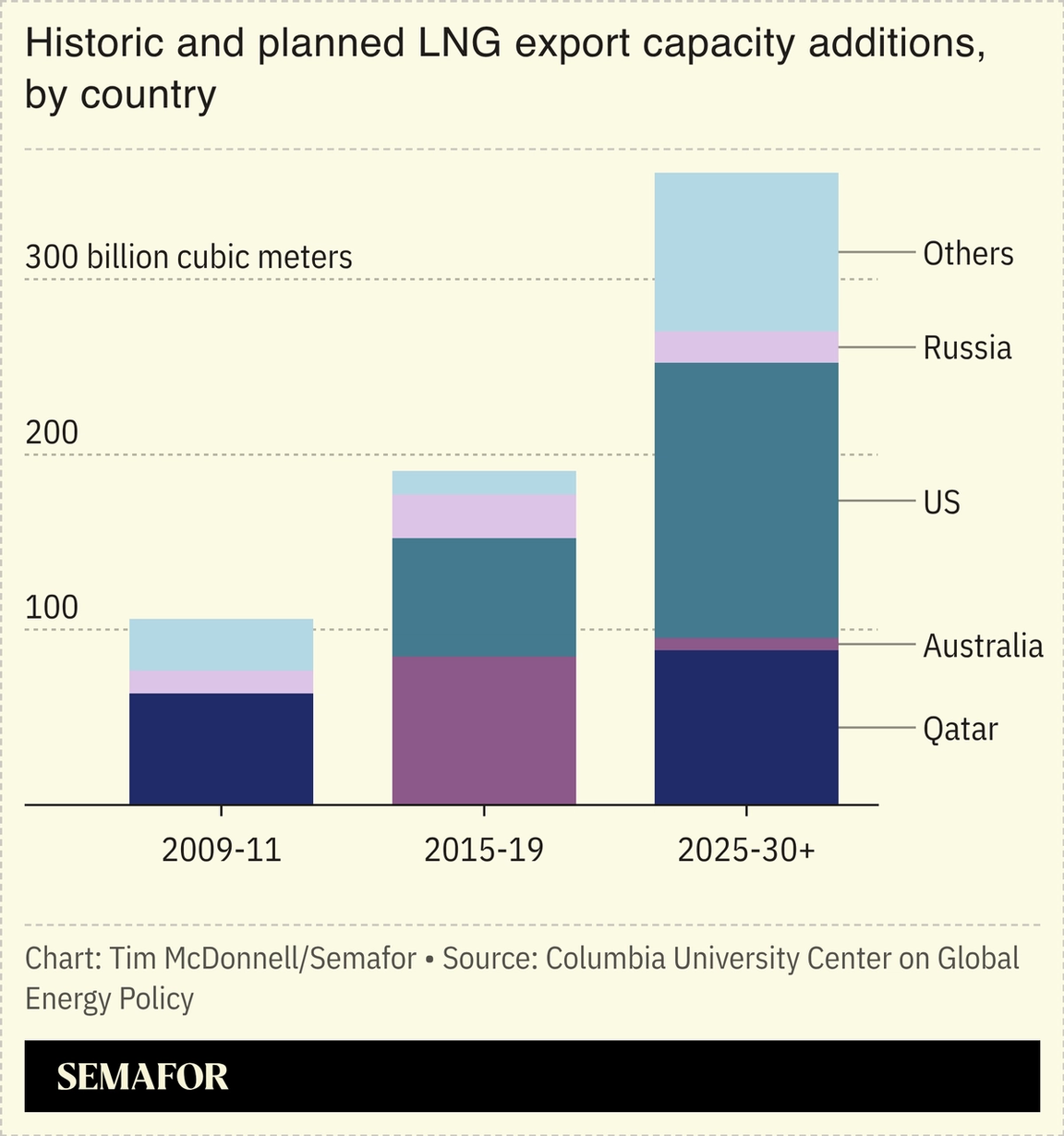

QatarEnergy is taking delivery of a new LNG tanker every three weeks, as it builds up a 200-strong fleet which will be the world’s largest. The company has received 38 vessels out of an order book of 128, which CEO Saad Sherida al-Kaabi called the biggest shipbuilding program in the LNG industry’s history. They are needed to handle the country’s ambitious energy plans, with LNG production set to double to 160 million tons a year by 2030. The next battle is finding customers. Deals were recently signed with Japan and Malaysia, but many more buyers are needed. It is not clear where they will all come from and, as an insurance policy, Doha has been building up its expertise in spot market sales, according to BloombergNEF. |

|

Gulf sought for education funding |

Students sharing a textbook in class in Gambia. Jim Cham/Global Partnership for Education. Students sharing a textbook in class in Gambia. Jim Cham/Global Partnership for Education.As Western aid budgets tighten, the Global Partnership for Education is turning to the Gulf in its $5 billion fundraising drive. Chief Executive Laura Frigenti told Semafor she expects Qatar, Saudi Arabia, and the UAE to increase contributions, and hopes Kuwait will back the 24-year-old Washington-based organization — which supports programs reaching nearly 750 million children — for the first time. The push follows the Trump administration’s shuttering of USAID and as funding for the UN and its agencies is facing shortfalls. In the organization’s last financing cycle, the UAE pledged about $100 million, Saudi Arabia $46 million, and Qatar roughly $20 million. Frigenti said the rapid transformation of Gulf education systems offered a model for other resource-rich economies, giving Gulf countries credibility as partners in education programs beyond simply providing funding. — Mohammed Sergie |

|

Semafor is proud to announce its first slate of speakers for the 2026 Annual Convening of Semafor World Economy, taking place April 13-17 in Washington, DC. This global cohort of senior leaders from every major sector across the G20 are just some of the 400 top CEOs joining Semafor World Economy for five days of onstage conversations and in-depth interviews on growth, geopolitics, and technology. See the first lineup of speakers here.

|

|

IPO- Richard Attias & Associates, the organizer of Saudi Arabia’s Future Investment Initiative summit, is working with Citigroup, Moelis & Co, and SNB Capital on an initial public offering which could be launched later this year and value the business at $1 billion. — Bloomberg

Logistics- The US urged American-flagged ships transiting the Strait of Hormuz to avoid Iranian waters and decline boarding requests from Iranian forces, as tensions with Tehran simmer despite recent indirect talks in Oman. — Al Jazeera

- Abu Dhabi Ports Group signed a 30-year concession to run Jordan’s Aqaba Multipurpose Port, forming a joint venture with Aqaba Development Corporation and investing to upgrade the country’s main cargo gateway.

Rail- Etihad Rail awarded design-and-build contracts worth an estimated $6.5 billion for the Abu Dhabi-Dubai high-speed line; the electric trains will run at up to 350kmph, cutting the journey time to 30 minutes. — Construction Week

Trade- The UAE and Gabon are expanding trade ties under a new partnership that will cut tariffs, ease investment, and boost private-sector cooperation, alongside plans for a joint business council and closer defense links.

Royal KickWilliam, the Prince of Wales, kicks a football while attending a girls’ football practice in Saudi.  Courtesy of the Saudi Press Agency Courtesy of the Saudi Press Agency |

|

Christopher Pike/Reuters Christopher Pike/ReutersOn Feb. 14, 2021, the UAE released the first image from Mars from its Hope Probe, becoming the first Arab nation to establish a scientific presence at the Red Planet. The spacecraft had entered Mars’ orbit days earlier, placing the UAE alongside China, the European Space Agency, India, Russia, and the US as the only ones to achieve the feat. Officials framed the photo as a defining national moment and proof that a Gulf space program could deliver complex scientific missions. Five years on, Gulf space ambitions are still unfolding: Oman is building the Etlaq Spaceport and promising to cut launch approvals to as little as 45 days in order to attract commercial rocket operators. Saudi companies are planning low-orbit satellite networks for secure regional communications, and Emirati officials say the model behind Hope (which encompassed both international collaboration and local capacity building) is being replicated across tech and science programs. |

|

| |