|

|

"Stepping back, over the past three weeks, Allianz Direct acquired two incumbent-backed initiatives—Friday and IptiQ's European business—while overlooking insurtechs. Within Guidewire, there's "a little bit of a fight" about whether CNA was the first customer, the second customer, or tied for first. Perhaps there's also a battle among insurtechs vying for Guidewire's attention. If there isn't, there should be."

– Our latest premium article, Guidewire Explores M&A Opportunities, delves into the successes and strategies of Guidewire.

|

|

|

$ |

Progressive released its financial results for October, ending the month with a combined ratio of 94.1% and net income of $408.2 million. For the first ten months of the year, Progressive generated $6.5 billion in net income and achieved a combined ratio of 89.6%.

The insurer had ~34.36 million policies at the end of October, an increase of 16% compared to October of last year. During the month, Progressive added around 496k new policies to its overall count. Since the beginning of the year, Progressive increased its total PIF count by ~4.6 million.

|

|

|

Aon Analyzer |

Aon has introduced its Cyber Risk Analyzer, a tool to help risk managers mitigate cyber risks. Capabilities include:

-

Loss Forecasting: Simulates potential loss scenarios like data breaches and system failures using Aon's proprietary models.

-

Exposure Assessment: Integrates with Aon's other tools, like CyQu, for a view of security controls and exposures.

-

Total Cost of Risk (TCOR) Analysis: Combines loss forecasts with insurance options to offer customized TCOR analyses.

This launch follows Aon's 2024 releases of similar tools for property, casualty, D&O, and health risks, expanding its suite of analytics-driven solutions.

|

|

|

Earnings highlights |

-

F&G reported a strong Q3 2024, with gross sales of $3.9 billion, up 39% year-over-year, and year-to-date sales of $11.8 billion, a 30% increase from 2023. Retail sales from agency bank and broker-dealer channels hit a record $3.5 billion in Q3, nearly doubling the prior year, bringing year-to-date retail sales to $9.5 billion.

-

Heritage has reduced policy counts by over 66,000 (14.2%), increased premiums in force by $80.6 million (6%), and resumed selectively writing Personal Lines business.

-

Before Hurricane Milton, Storm Boris impacted KBC's bottom line. KBC, a bank-insurer with an 88% to 12% bank-to-insurance split, reported notable achievements with its digital assistant, Kate. Kate has engaged over 5 million customers, boosting productivity by 1% to 1.5%. Over the past 12 months, it independently facilitated the sale of 236,000 products, equivalent to the workload of about 300 employees.

|

|

|

🚗 Car coverage |

Mercedes-Benz Insurance Services UK has partnered with Wrisk to deliver its new car insurance proposition, replacing Lloyd Latchford Group as its administrator. Existing customers are being transitioned to the new solution, which includes a five-day First Cover offer for Mercedes-Benz and smart cars at the point of sale.

Insurance is underwritten by Highway Insurance Company, part of Allianz.

In 2023, Mercedes-Benz Insurance Services UK reported £3.3 million in insurance brokerage commissions.

|

|

|

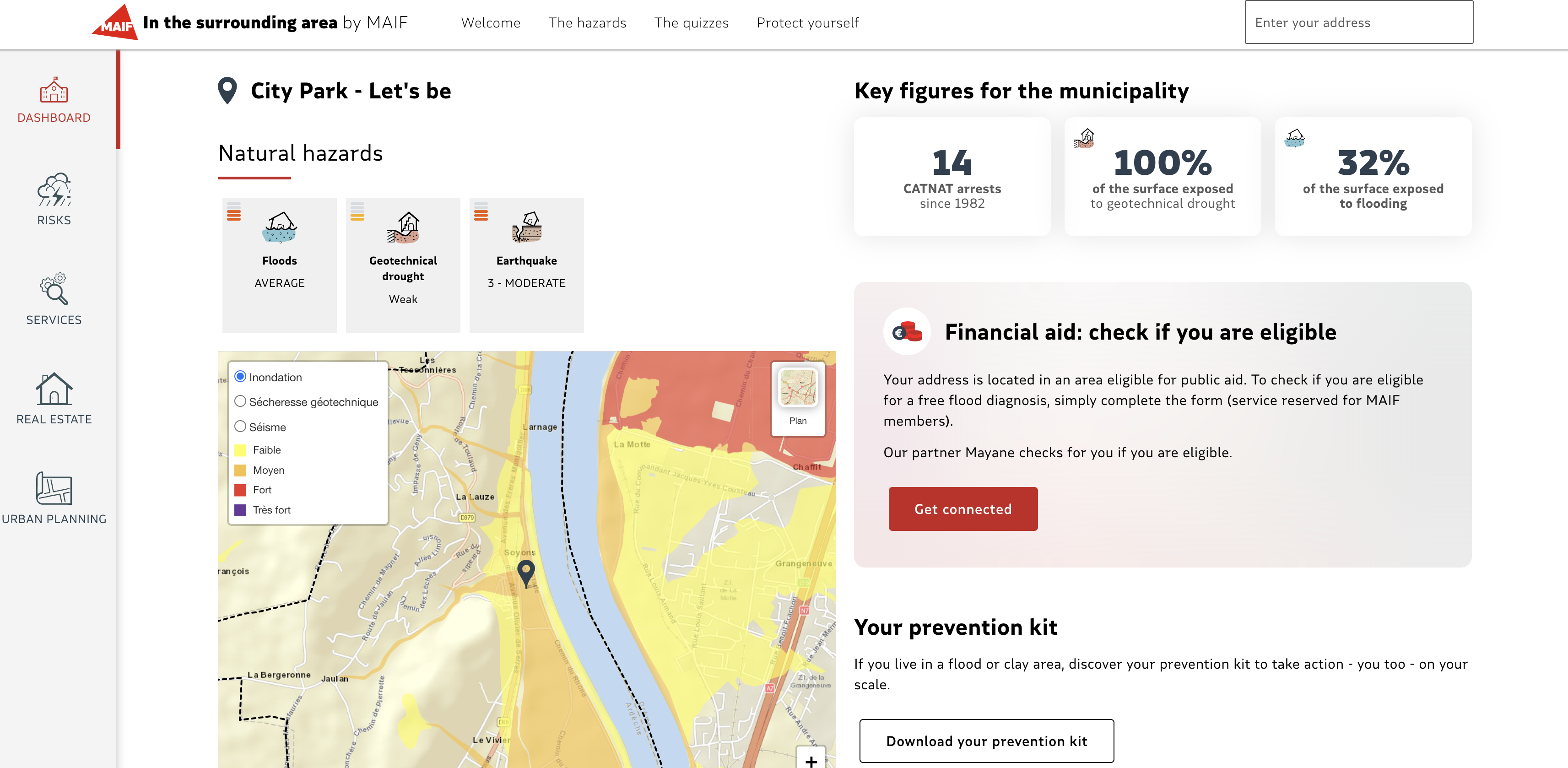

Free from MAIF |

|

MAIF launched "Aux Alentours by MAIF," a free tool to help users understand and reduce climate risks to their homes by providing data on hazards, local amenities, and real estate prices based on their address. Eligible members can access support through the Barnier Fund or MAIF programs.

Bottom Line: The "preventive insurer."

|

|

|

For the digital workplace |

|

Wallit, a digital wallet and payment platform, raised $1.4 million in its latest funding round announced on November 15, 2024.

Founded in 2020, the company operates with a team of 10, focusing on employee benefits by enabling businesses to customize, automate, and streamline programs through its digital wallet.

Wallit offers a free plan for small teams (2-25 people), a "Plus" plan at $5.55 per employee per month for businesses with 25-1,000 employees, and a custom-priced "Enterprise" plan for larger organizations.

|

|

|

🍾 |

-

AssuredPartners announced the appointment of Sean Smith to president of AssuredPartners, including retail and wholesale segments.

-

SBLI announced the appointment of Wade Seward as chief distribution officer.

|

|

|

Member Content |

|

|

|

BECOME A MEMBER

|

|

|

Latest From Coverager Research |

|

Become a client. |

|

|

Now Hiring |

American Family Insurance, Galecki Search Associates, Great American Insurance Group, Nationwide, The Hanover, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Foremost, EnergySolutions, QuinStreet, John Hancock, Aspire General Insurance Services. |

|

|

This Month on Coverager Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|