|

|

"It was decided that, while no one wanted to change some of the long-standing "quirky" styles (teen-ager, per cent, etc.), some of newer vintage could go. Along with a few other changes, "in-box" is now "inbox," "Web site" is now "website," "Internet" is now "internet," and "cell phone" is now "cellphone" (though everyone acknowledges that the word "cell" in this context will soon disappear altogether)."

– The New Yorker announced that the magazine completed a "reëxamination" of its house style.

|

|

|

Sponsored |

|

At first glance, having the most profitable Medicare season comes down to matching your distribution channels to the anticipated size of the market opportunity in a particular state and planning your sales coverage accordingly. Yet, optimizing your distribution channel management is more complex than "park a bunch of agents in Florida."

Before you ramp up your producer force for Medicare open enrollment, understand your market risks and opportunities.

|

|

|

Improving |

Clearcover Insurance Company, the carrier subsidiary of car insurance startup Clearcover, has released its 2024 results, ending the period with $144 million in written premiums, a decrease of 15% compared to 2023.

The carrier reported a net underwriting loss of $20 million for the year, compared to a $43 million loss in 2023.

Loss ratio, excluding loss adjustment expenses and other underwriting expenses, was 84.9% for the year, an improvement of 33 percentage points compared to 2023. Combined ratio was 133% in 2024, an improvement of 30 percentage points compared to 2023.

|

|

|

Sponsored |

The Future of Insurance: AI & Technology |

|

How will AI shape insurance agencies in the next five years? Join industry experts as they explore AI-driven efficiencies, InsurTech collaborations, and the future of analytics in insurance. Don’t miss this essential discussion—register now!

Register here

|

|

|

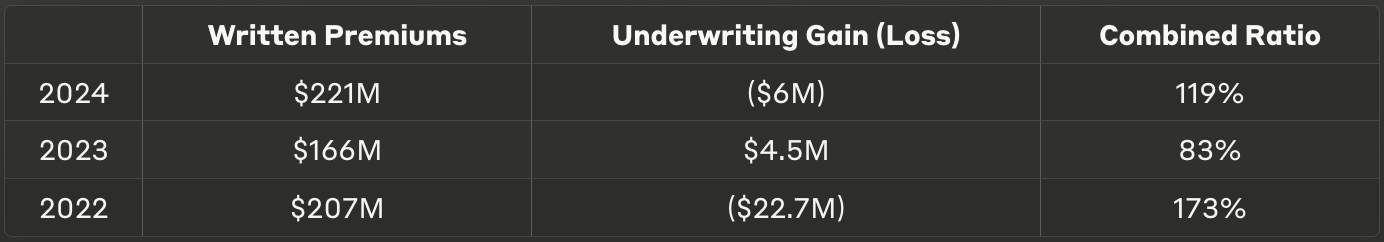

Next Insurance |

Next Insurance US Company, the licensed carrier owned by Next Insurance, released its 2024 results. Premiums decreased in 2023 due to a focus on profitability.

|

|

Next Insurance also has a program with State National, which reported $310 million in written premiums produced by Next, an increase of 40% compared to 2023.

|

|

|

Will they sell more home insurance?

|

Lemonade has adopted the ZestyAI platform to further optimize underwriting for key catastrophe perils in the US.

|

|

|

🤝 |

|

bolt has partnered with wireless and internet provider C Spire to launch C Spire Tech Protection, which provides home device coverage and tech support.

The package costs $21.99/mo for an unlimited number of home devices covered against accidental damage and malfunctions. Customers will also receive free Norton 360 Deluxe protection from day one ($120/yr value).

|

|

|

Cool milestone |

"Distribution partnerships with some of the most successful digital companies in the world – including Nubank, ByteDance, Shopee and others – give us access to hundreds of millions of customers."

– Chubb.

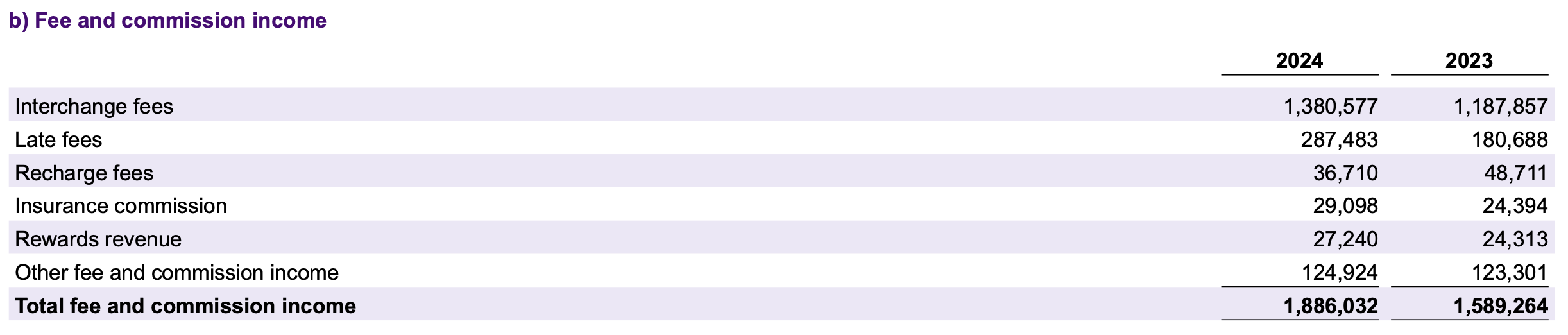

Since Nubank is mentioned, here's a tidbit: In November 2024, the digital bank reached 100 million customers in Brazil. Chubb and Nubank have been partners since December 2020 and last year, Nubank reported $29 million in insurance commissions – that's 29 cents per year per customer or 0.252% of its revenue.

|

|

But it's cool: "Our digital unit that serves international consumer, nonlife and life, reached a cool milestone last year, surpassing more than $1 billion in premiums, and it generated an underwriting profit."

|

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

Now Hiring |

GradGuard, Obie, Arch Insurance Group, Berkshire Hathaway GUARD, Galecki Search Associates, Mercury Insurance, The Hanover, Travelers. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Clearspeed, Zywave, First Acceptance, Slayton Search Partners, Synchrony. |

|

|

This Month on Coverager Data |