|

|

"I would tell you an example of a state that has shifted dramatically would be one that you just mentioned, the state of Georgia. Where once upon a time, that was an easier place to do business, but it has become ever more aggressive as far as the plaintiff bar goes."

W. Robert Berkley, Jr., on social inflation during Monday's earnings call.

|

|

|

💰 M&A |

Nationwide is acquiring Allstate's employer stop loss business for $1.25 billion. The deal is expected to close in late 2025, pending approvals.

"As Nationwide continues to focus on our mission to protect people, businesses and futures with extraordinary care, this acquisition is a strong fit. We are extending our protection solutions to meet the needs of business owners today and into the future." – Nationwide CEO Kirt Walker.

"We reached another milestone in the strategy to maximize shareholder value by combining the Health & Benefits businesses with companies that have greater strategic alignment. Group Health provides stop-loss insurance to small businesses, which will gain access to Nationwide's complementary product offerings. When combined with the previously announced sale of Employer Voluntary Benefits to StanCorp Financial Group, Inc., total sale proceeds will be $3.25 billion. The Individual Health business, with Adjusted Net Income of $18 million for the first nine months of 2024, will either be retained or combined with another company." - Allstate CEO Tom Wilson.

Bottom Line: Allstate's employer stop-loss segment provides coverage for over 13,000 small businesses.

|

|

|

🐔🥚 |

This week, Church Mutual filed with the Florida Office of Insurance Regulation to propose revised billing fees and payment plan options for its workers' compensation program, set to take effect on September 15, 2025.

This is part of Church Mutual's transition to a new billing system.

Recall that in 2022, Church Mutual selected BillingCenter on Guidewire Cloud as the billing management system for its four companies.

|

|

|

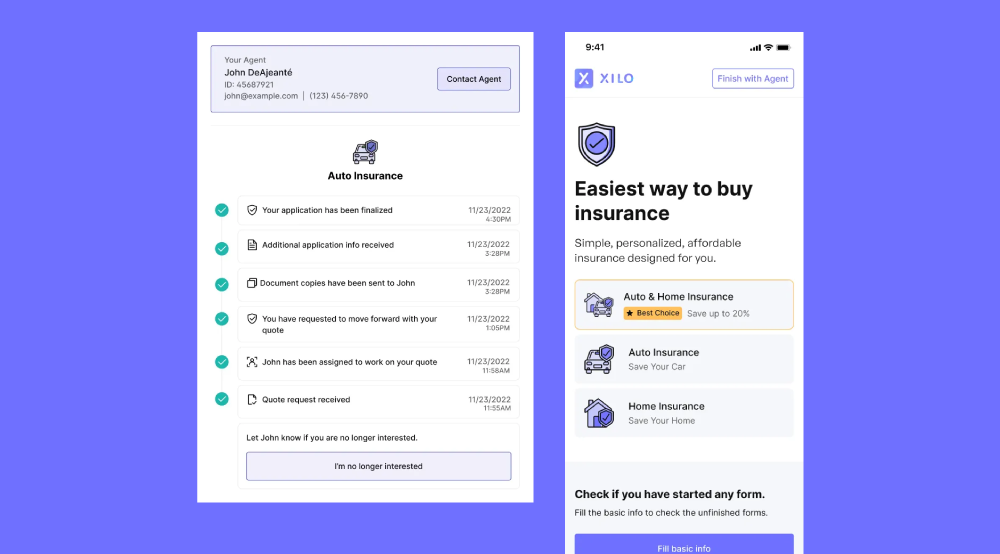

Automation platform |

|

San Diego-based XILO, a quoting software provider, raised $7.2 million in a Series A round, bringing its total funding to $13.2 million.

Founded in 2017, XILO streamlines quoting with customizable digital intake forms that integrate with Agency Management Systems and raters. Clients include Towne Insurance and Partnership Insurance Agency.

|

|

|

👨⚖️ |

|

A class action lawsuit alleges Liberty Mutual unfairly non-renewed California homeowners' policies based on inaccurate aerial inspections.

|

|

|

New products |

-

🏍️ Babel Cover, backed by Markd, has partnered with Warranty Solutions Group to launch BMIC, a motorcycle warranty brand for UK riders.

-

❄️ Wallife has partnered with Tomorrow Bio to launch Europe's first cryopreservation insurance, available in 2025, covering risks associated with vitrification.

|

|

|

New processes |

-

Tower Insurance is leveraging the integration between Panel Quote and Hello Claims to streamline claims processing, allowing repairers to submit quotes, invoices, and file notes through Panel Quote.

-

NEXT Insurance is leveraging Sutherland's digital solutions to enhance its customer experience for small businesses.

-

Celina Insurance has selected Majesco Intelligent Claims to modernize its P&C claims operations.

-

Xceedance has partnered with mea Platform to deliver AI-driven solutions aimed at enhancing underwriting, claims workflows, and operational efficiency for insurers.

-

GIC Underwriters implemented Indemn's AI agent to automate broker inquiries, resulting in 46% of questions being handled by the AI with 95% accuracy.

-

Tokio Marine HCC International has partnered with Optalitix to enhance its London Market underwriting and pricing systems.

-

Pathpoint partnered with Heron to automate the ingestion and evaluation of inspection reports, streamlining workflows and reducing manual processing time in commercial insurance.

That's Coverager Data.

|

|

|

Transamerica relief |

Transamerica is waiving certain retirement plan transaction fees for participants affected by the Southern California wildfires. The company is informing plan sponsors and participants about disaster relief options, including penalty-free withdrawals of up to $22,000.

|

|

|

🦎 👀 |

GEICO has initiated a review to expand its creative agency roster. |

|

|

Coverager Research |

Our Latest Research – Seed to Shift? An Overview of the Current Pet Insurance Market |

|

|

Now Hiring |

Acuity Insurance, American Family Insurance, Berkshire Hathaway GUARD, Galecki Search Associates, Nationwide, Protective Life, The Hanover, Travelers, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: SambaSafety, Nirvana Insurance. |

|

|

This Month on Coverager Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|