|

|

"We have made change to our leadership team across our North American business, starting at the top. We now have in [ Bill Hazelton ], a world-class leader at the top of the house in North America insurance. We hired new leaders for our casualty business, for financial lines, for wholesale and in our field operations. We have a new leader for North American insurance claims, and we've added superb talent to our actuarial, analytics and CUO teams. Our portfolio is undergoing rapid and positive change. In casualty, we have an account level plan to remediate the book using what I call a one renewal standard. That means we will return every casualty account to target profitability in one renewal or we will get off the account. Period. We are not afraid to lose unprofitable business as evidenced by third quarter results, where 37% of our casualty premiums were not renewed and those accounts that were renewed went through substantial structural and rate changes. We are prudently growing in areas where we've consistently earned solid returns, which is bringing balance to our book."

– Everest CEO after reporting unfavorable development of prior year loss reserves of $1.5 billion.

|

|

|

Sponsored |

|

When insurance companies are choosing a payment processor, there's more to consider than just cost. To help you navigate the decision-making process, here's a checklist that breaks what to consider when evaluating payment solutions for insurance premiums.

|

|

|

10k+ |

In mid-January, State Farm provided an update on home and auto claims related to the LA wildfires, which resulted in 6,700 claims that were processed by the insurer.

The company is now providing another update – as of Monday (Jan. 27), State Farm received over 10,100 home and auto claims with payouts of almost $500 million. The insurer added that it made successful voice-to-voice contact with over 95% of customers who have filed homeowner claims.

State Farm is the largest insurer group in California and in LA County, it insures 250,000 homes and 880,000 automobiles. In total, the company has more than 8 million policies and accounts in the state.

|

|

|

💰 |

|

The Helper Bees, a platform offering home services for older adults, announced a $35 million funding round led by Centana Growth Partners, with participation from Silverton Partners, Impact Engine, Northwestern Mutual Future Ventures, and Alumni Ventures.

Founded in 2015, The Helper Bees' network of providers offers a range of services around home caregiving, home modifications, groceries and meals, pest control, housekeeping, and transportation. The company has more than 20,000 credentialed providers and it is in network with 43 payers.

The Helper Bees reached profitability last year.

|

|

|

🤝 |

Tokio Marine HCC International has partnered with Optalitix, a provider of data analytics and pricing solutions, to enhance its London Market underwriting and pricing systems.

The partnership will see all of TMHCCI's pricing models for its London Market division transition to the Optalitix underwriting platform over the next two years.

|

|

|

Approved |

Mangrove Property Insurance Company has been approved by Florida's Office of Insurance Regulation to provide P&C insurance to Florida homeowners.

The OIR approved Mangrove's certificate of authority to provide coverage on January 15, 2025. In addition, Mangrove has been approved to participate in the April assumption of policies from Citizens Property Insurance Corporation. The company has applied for a Financial Stability Rating from Demotech and plans to begin writing homeowners coverage outside of Citizens as soon as possible after receipt of that rating.

Mangrove is led by Stephen Weinstein, a former general counsel at RenaissanceRe.

|

|

|

🍾 |

-

AIG announced that Jon Hancock (EVP and CEO, International Insurance) will assume additional responsibility for the newly formed Global Personal Insurance business, which brings together the company's Global Accident & Health, Personal Home and Auto, Global Warranty & Services, and High-Net-Worth businesses. Hancock will continue to lead the International Commercial Insurance business.

-

AXA XL has appointed Tim Whisler to lead its Wholesale Business in the Americas.

|

|

|

Update |

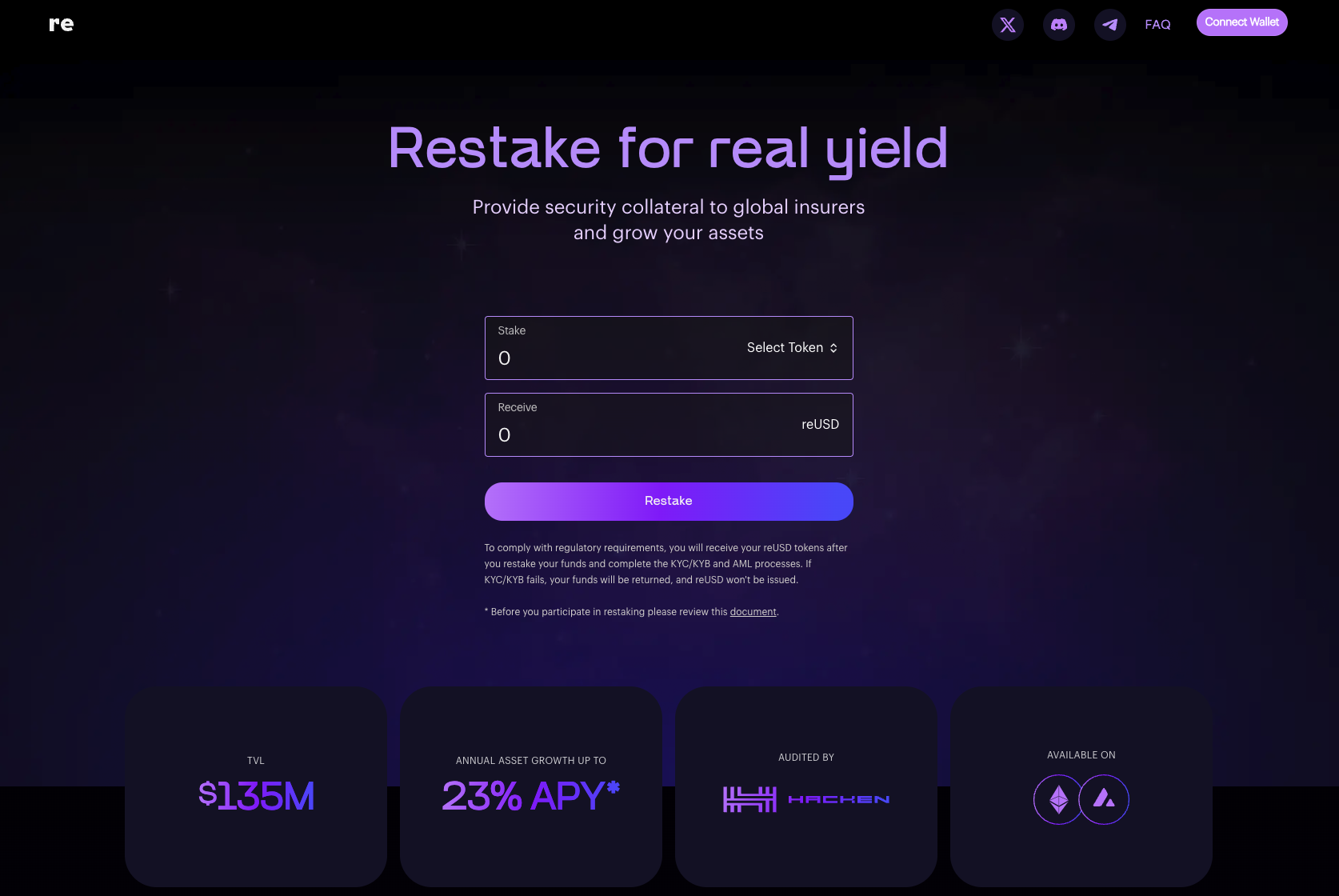

Re.xyz went from this: |

|

To this: |

|

Now, coverre.com is the original re.xyz, while the new re.xyz is not available in the US. |

|

Read about the original Re here. |

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

Now Hiring |

Travelers, Acuity Insurance, Galecki Search Associates, American Family Insurance, Berkshire Hathaway GUARD, Nationwide, Protective Life, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Munich Re, Liberty Mutual, Verisk. |

|

|

This Month on Coverager Data |

|

|