|

|

"After spending 41 years in the insurance industry, this is an announcement I never anticipated delivering."

- Mark Davey, President and CEO of Stillwater, following AM Best's downgrade of the Financial Strength Rating for Stillwater Insurance Company and its subsidiary, Stillwater Property and Casualty Insurance Company, from A- to B++.

|

|

|

Sponsored |

AI that actually works (and saves you 10+ hours a week) |

|

Most AI tools promise the moon and deliver a chatbot that says "I'm sorry, I didn't understand that." Not this.

AI Insurance's free guide breaks down how you can start using AI today to:

Automate quoting so underwriters stop drowning in busywork Speed up claims processing and policy renewals by 75% Fix your financial chaos for fewer errors and faster invoicing No engineering lift or 6-month implementations. Just fast AI that works. Get the guide every MGA should read. |

|

|

$PGR |

Progressive released its financial results for March, ending the month with a combined ratio of 90.9% and net income of $522 million. Year-to-date, Progressive's net income stands at $2.5 billion and combined ratio sits at 86%.

The insurer had ~36.3 million policies at the end of March, an increase of 18% compared to March 2024. During the month, Progressive added around 672k policies to its overall count. For the first quarter of the year, Progressive added 1.3 million policies to its overall count.

In other Progressive news, the company announced the launch of Cargo Plus, a new endorsement that expands Motor Truck Cargo coverage purchased by for-hire truckers and other eligible customers. |

|

|

Acquiring |

Markel has entered into an agreement to purchase The MECO Group Limited, subject to regulatory approval.

Founded in 1974, MECO is a specialist marine managing general agent based out of London, Dubai and Shanghai. It provides marine insurance products and services to a diverse range of global marine clients, including charterers and traders, shipowners and entities engaged in maritime operations and global supply chains. It wrote $63 million GWP in 2024. |

|

|

💰 |

|

Canadian digital insurance provider PolicyMe announced $30 million CAD in additional funding, secured through multiple tranches of equity and debt financing between 2023 and 2025, from strategic partners including Blue Cross Life Insurance Company of Canada and Securian Canada. This follows its $3.3 million CAD seed round in 2020 and its $18 million CAD Series A in 2022, bringing total funding to $51 million.

Launched in 2018 to simplify the process of buying life insurance, PolicyMe now offers critical illness insurance as well as health and dental coverage backed by Securian Canada. The company says it protected 18k+ customers and issued more than $10 billion in coverage.

Aside from its D2C model, the company also has a B2B2C channel and Blue Cross Life leveraged PolicyMe's technology to launch life insurance and critical illness products. |

|

|

Fintech |

Luma Financial Technologies, a platform offering structured products and insurance solutions, has closed a $63 million Series C financing led by Sixth Street Growth, with participation from Bank of America, Morgan Stanley, UBS, and TD Bank Group.

Founded in 2018, Luma offers a buy-side technology platform that helps financial teams more efficiently learn about, research, purchase, and manage alternative investments as well as annuities. The company also plans to give advisers access to life insurance in the future. |

|

|

|

Sapiens says |

Universal Life, a Cyprus-based insurance company offering a range of life, health, pension, and investment products for individuals and organizations, has entered into a "conditional agreement" to adopt Sapiens CoreSuite for Life & Pensions, aiming to modernize its core systems and support strategic growth.

👂👇 |

|

|

|

Lemonade is entering Trupanion's territory |

|

Bottom Line: The grass is always greener on the other side. |

|

|

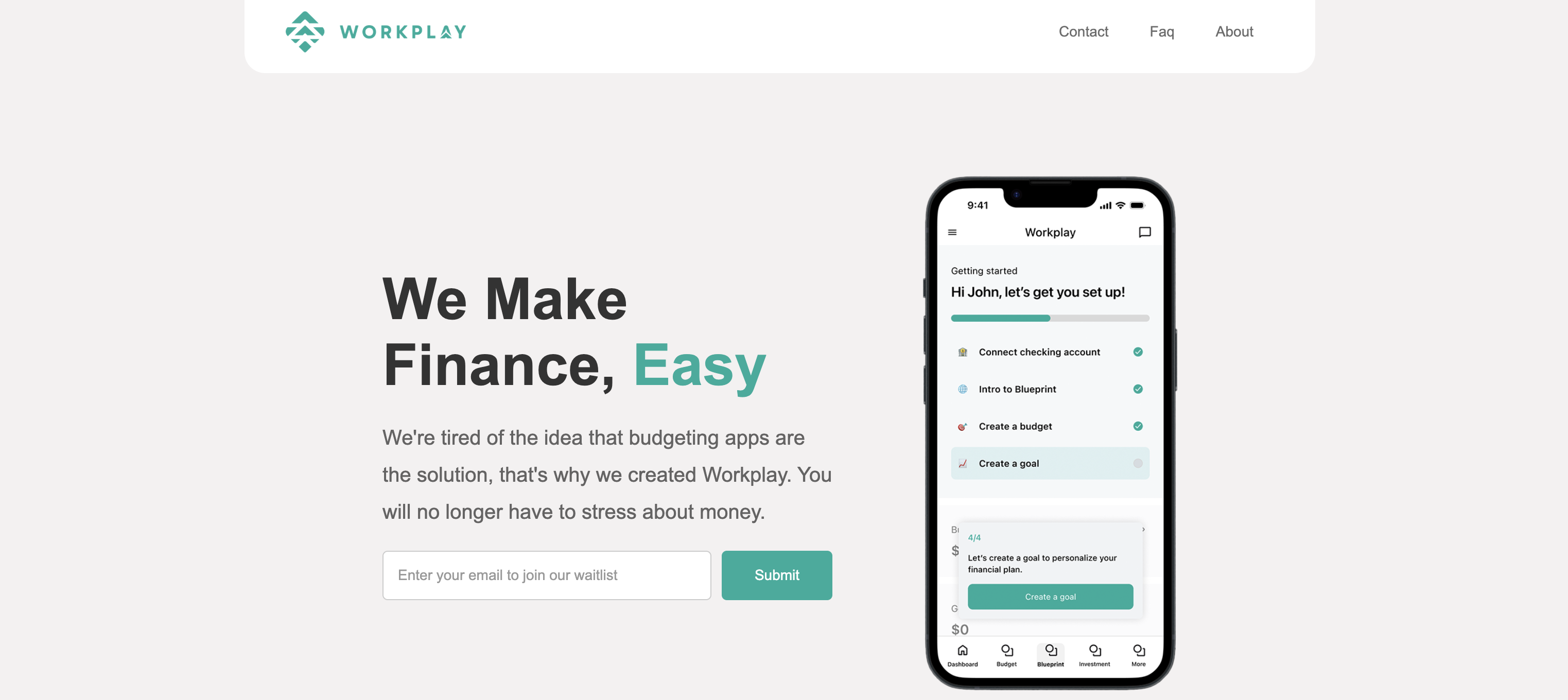

👀 Workplay |

|

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

|

Now Hiring |

Acuity Insurance, Foresight Risk & Insurance Services, Inc., Galecki Search Associates, Main Street America Insurance, Mercury Insurance, MGT Insurance, Simply Business, The Hanover.

View all open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Volvo, GEICO, Assurant. |

|

|

This Month on Coverager Data |

|

|