|

|

"National General's weak cybersecurity emboldened hackers to steal New Yorkers' personal data, not once but twice in two separate cyberattacks. National General mishandled New Yorkers' personal information and violated the law by failing to inform them that their data was stolen. It is crucial that companies take cybersecurity seriously to protect consumers from fraud and identity theft, and my office will always hold those who fail to do so accountable."

– NY Attorney General sues Allstate over data breaches.

|

|

|

Sponsored |

Leveraging AI for Agency Growth |

|

Discover how leading agencies are using AI and InsurTech to drive efficiency, enhance analytics, and streamline new business processes. Gain expert perspectives on the future of insurance brokerage and actionable strategies to stay ahead. Save your spot today!

Register here.

|

|

|

360 |

Home insurance startup Openly has generated a total of $360 million in written premiums in 2024 for its carrier partners Rock Ridge Insurance Company and MS Transverse Insurance Company. The majority of premiums ($350.7M) were reported by Rock Ridge.

In 2023, Openly produced $301 million in written premiums.

On the loss side, Rock Ridge reported $299 million in paid losses for the homeowners line in 2024.

Founded in 2021, Openly raised ~$360 million in equity and $70 million in debt. Its latest round was announced in January. The startup offers coverage in 24 states.

|

|

|

Backed by Progressive |

|

Digital mortgage lender Tomo closed its $20 million Series B financing round, bringing its total investment to date to $130 million. Progressive, Ribbit Capital, NFX, and DST Global Partners participated in the funding round.

Tomo, which operates in 31 states, claims to saves the typical homebuyer $4,000 at closing and its interest rates are, on average, 0.50% lower than the industry and up to 1% lower than some of the biggest lenders.

"We're excited to invest in Tomo and to support their mission to modernize the home buying experience. Our forward-thinking approach and dedication to being there for our customers by understanding their specific needs aligns with Tomo's focus on innovation and helping each individual customer achieve their homeownership dreams." – Erwin Raeth, Corporate Development Leader at Progressive.

|

|

|

Coverage |

-

Travelers introduced Travelers Synergy, a new customizable product liability coverage tailored to life sciences companies.

-

Commercial property insurer FM announced its insurance policy for renewable energy operation is now available to clients in Europe, the Middle East and Africa.

|

|

|

💰 |

-

Trust & Will, a startup offering a service to create, edit, store, and share trusts and wills, announced the successful close of its $25M+ Series C funding round. Northwestern Mutual Future Ventures, Erie Strategic Ventures, and others participated in the round.

-

XUND, a Vienna-based startup that enables healthcare companies to digitize patient interactions and translate data into actionable insights, has raised €6 million in Pre-Series A funding led by Budapest’s Lead Ventures, with participation from MassMutual Ventures and others.

|

|

|

According to sources |

Ageas and Allianz are exploring a bid for British insurance group esure.

|

|

|

👋 |

|

|

|

Batman vs. Bateman |

|

|

|

Coverager Research |

|

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

Now Hiring |

Obie, Arch Insurance Group, Berkshire Hathaway GUARD, Galecki Search Associates, Mercury Insurance, The Hanover, Travelers. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Avondale, Obie, LifeMAP, Y-Risk, Zurich. |

|

|

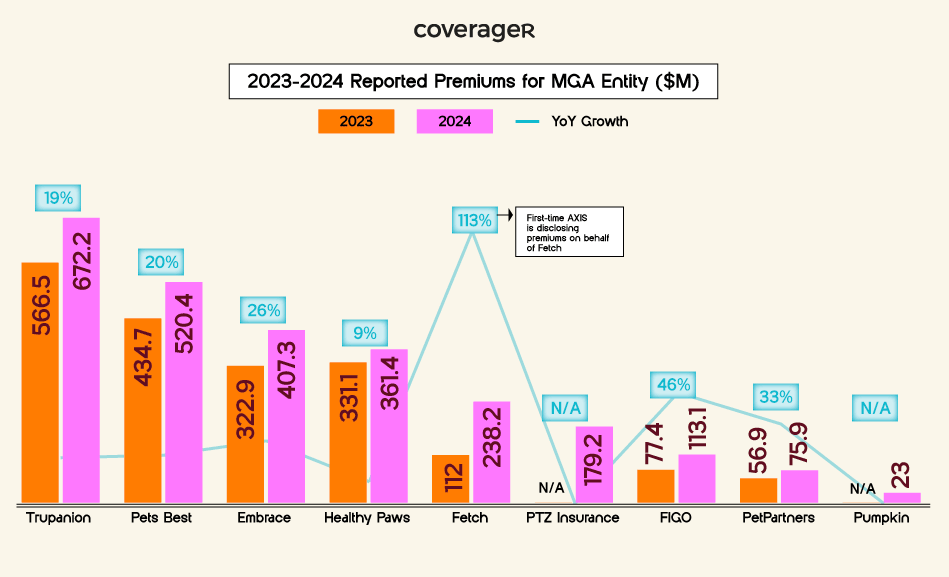

This Month on Coverager Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|