|

|

"While the promise of agentic AI charts a new frontier of product opportunity, a clear roadblock stands in its way: Today's software systems are built for humans, not AI. Modern applications and websites are, unsurprisingly, designed with humans in mind. Functions and information are organized in a way that is aligned with human intuition and built to perform to the limits of human users, with context that is siloed across various devices and platforms. AI agents are capable enough today to adapt poorly to these interfaces of the past, but a new foundation is required to unlock AI's full potential to transform how everyone uses software in their day-to-day lives."

– A group of former Google and Stripe executives who helped build the Android platform have raised $56 million for a new company focused on developing an operating system for artificial intelligence agents.

|

|

|

New wealth |

|

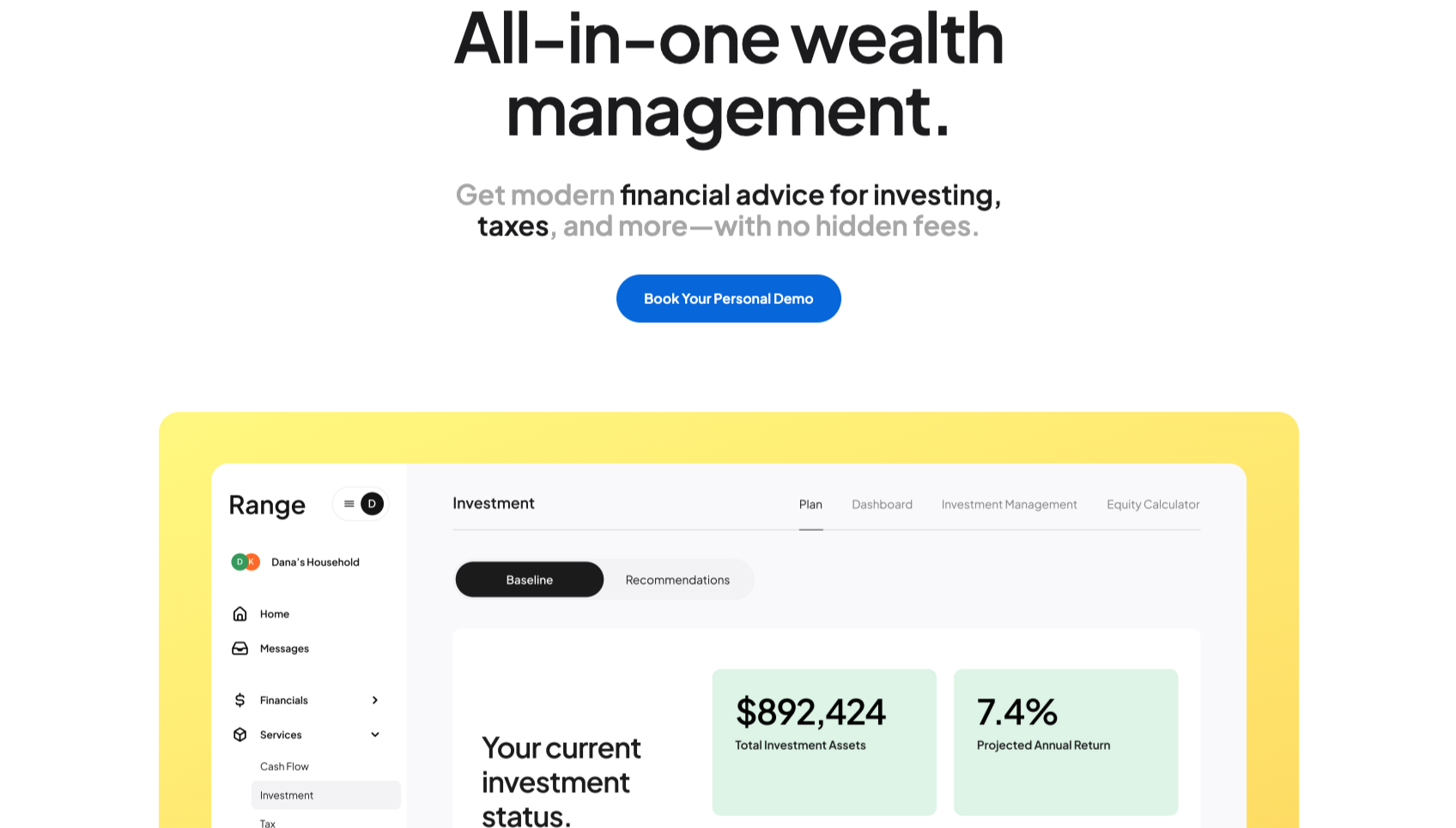

Wealth management platform Range has raised $28 million in Series B funding, bringing its funding to date to $40 million.

Founded in 2021, the Virginia-based startup offers members a range of wealth management solutions including investment services, tax, estate, and retirement planning.

The startup, which claims that its AI engine can provide superior advice 10-20x faster and save their members 75-90% more in fees than traditional wealth advisors, has attracted more than 1,000 high-net-worth members and now advises them on nearly $3 billion in assets.

|

|

|

International news |

-

Everest announced its expansion into the Italian market. The launch follows Everest's recent expansion into other key international markets, including Australia, Colombia and Mexico.

-

Aon announced the signing of a definitive agreement to acquire the in-house insurance agency business of Japanese company Mitsubishi Chemical Group.

|

|

|

Glencar Insurance 🤝 BriteCo |

|

Glencar Insurance Company, through its partnership with BriteCo, has filed with the Florida Office of Insurance Regulation to introduce a Special Event Liability program.

|

|

|

Zinnia shifts |

Zinnia is firing (it recently laid off 25 employees at its Topeka location according to the Topeka Capital-Journal) and hiring—the company has an open position for a Sales Director, sharing that it has over $173.7 billion in assets under admin across 100+ carrier clients, 2,500 distributors and partners, and over 2 million policyholders.

|

|

|

Dot AI |

|

Accelerant swapped its URL from https://www.accelins.com to https://accelerant.ai.

In separate news, Accelerant has filed to introduce a BOP program in Oregon, a development likely to benefit Rainbow.

|

|

|

Simply nice |

|

|

|

Post IPO |

Abacus Life raised $100 million through an oversubscribed public offering of 12.5 million shares at $8 each. The company generated $80 million from 10 million shares, while stockholders contributed $20 million by selling 2.5 million shares.

Abacus – the only life settlement company that's publicly traded – will use the funds to buy life settlement policies, support its strategy, fund acquisitions, and refinance debt.

|

|

|

New entrant |

|

In Good Time Insurance Services is a Dallas-based insurance agency founded in 2024 specializing in final expense life insurance for individuals aged 50 to 85.

It partnered with American General Life and American-Amicable, to name two out of three carrier appointments.

|

|

|

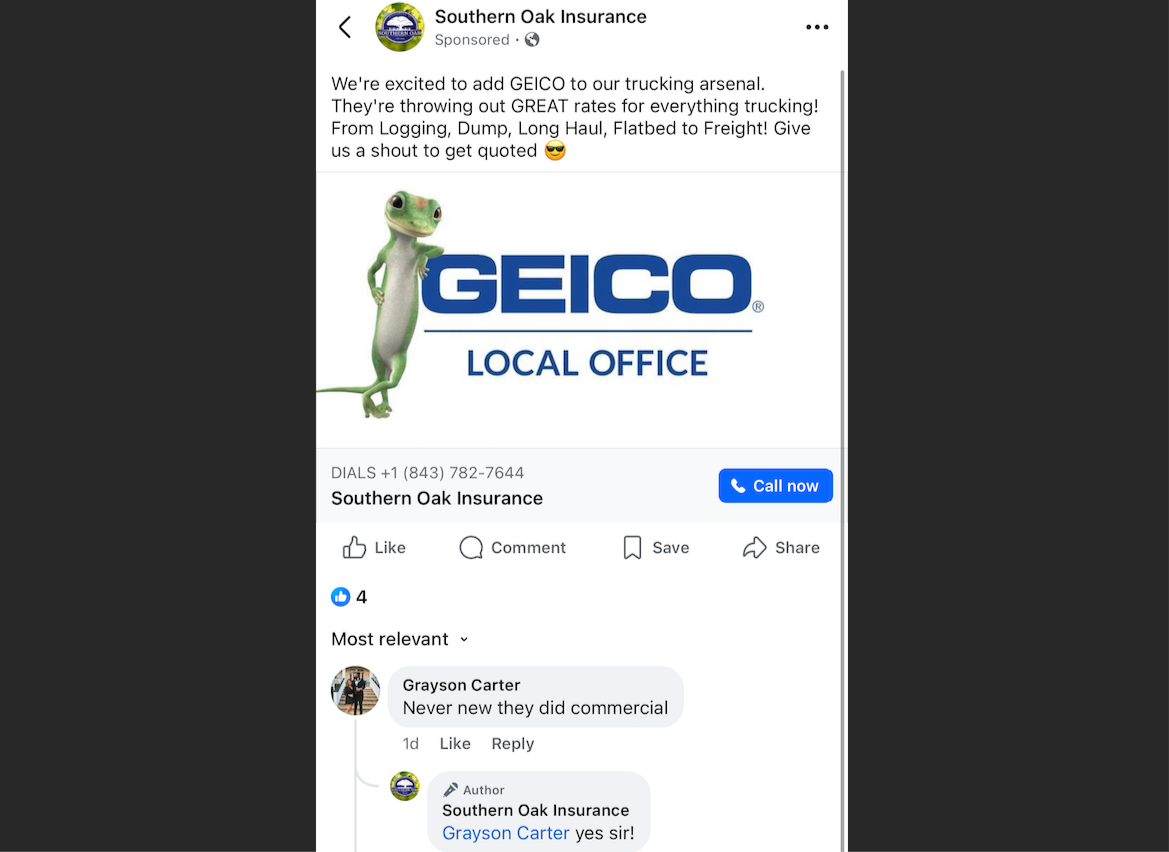

Grayson now knows |

|

|

|

"Temporary disruption" |

Ondo Insurtech announced a contract with Peril Protect and LeakBot USA Inc. to provide LeakBot devices to Indiana Farm Bureau Insurance homeowners. Indiana Farm Bureau will deploy LeakBot in ~10,000 homes over the next year under a two-year agreement, including upfront payments. This marks Ondo's first US rollout skipping the pilot phase.

Peril Protect is an on-and-off home monitoring service for water leaks that's currently experiencing a temporary disruption in system availability.

Bottom Line: Timely research article👇.

|

|

|

Latest Research |

|

Become a client. |

|

|

Now Hiring |

American Family, Galecki Search Associates, Great American Insurance Group, Tint, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: InsureMO, American Family, Mutual Benefit Group, Mission Underwriting Managers. |

|

|

This Month on Coverager Data |

|

|

|

|

|

|

|

|

|

|

|

|