|

|

"A new chapter is unfolding."

– Agency Distribution report, L&H edition, page 3.

We tracked over 1,100 agency appointments across nearly 150 carrier groups in Life & Health, and over 2,600 appointments across more than 2,200 agencies and nearly 400 insurance entities in Property & Casualty.

|

|

|

|

🤝 |

Belgian insurer Ageas will acquire UK-based digital insurer esure from Bain Capital for around $1.7 billion. esure is known for its strong presence on price comparison sites and in 2024 it had more than 2.1 million policies and GWP of £1 billion.

"We are delighted to have reached an agreement to acquire esure. In recent years, Ageas has experienced significant growth in the UK, making it an increasingly important part of the Group. This transaction will allow us to offer competitive value propositions to a wider customer profile via a multi-channel distribution model, positioning Ageas UK as one of the top three personal lines insurers." – Hans De Cuyper, Ageas Group CEO.

|

|

|

Rebrand |

RSA will rebrand and change its trading name to Intact Insurance by the end of 2025.

"The transformation of the UK business since it was acquired by Intact in 2021 has been exceptional. Intact has a global footprint with big aspirations for the future and RSA is already a significant contributor. Aligning under the Intact brand is a natural next step in our strategy to strengthen our leading position in the UK, Europe and Ireland." – Charles Brindamour, CEO, Intact Financial Corporation.

|

|

|

Medical records |

Paris-based Klaimy, which helps insurers process medical documents, has raised €1.2 million in pre-seed funding led by Insurtech Gateway, with participation from U-Investors, Tenity, and angel investors.

Founded in 2023, Klaimy claims that its accuracy rates are above 98% for medical condition extraction, and their platform is designed to tackle fraud, missing data and clinical inconsistencies.

|

|

|

Sold❗ |

Hannover Life Re of Australasia will acquire Swiss Re Life & Health Australia's direct life insurance business, previously sold under the iptiQ brand. The deal, subject to regulatory and court approvals, is expected to close within 18 months.

This follows Swiss Re's sale of iptiQ's EMEA P&C unit to Allianz Direct and marks its full exit from the APAC region.

Terms were not disclosed.

|

|

|

Rated |

|

On April 7, Eden Insurance Company filed a trademark application for a stylized lowercase letter "e" (see above).

In separate news, AM Best assigned an A- (Excellent) rating to Eden Insurance Company and affirmed the same rating for IMT Insurance and Wadena Insurance Company, removing their "under review" status. The outlook for all three companies remains negative.

Eden, part of the IMT Insurance Group, was established to expand the group's presence in the farm mutual market and is fully reinsured by IMT.

|

|

|

Seed stage |

|

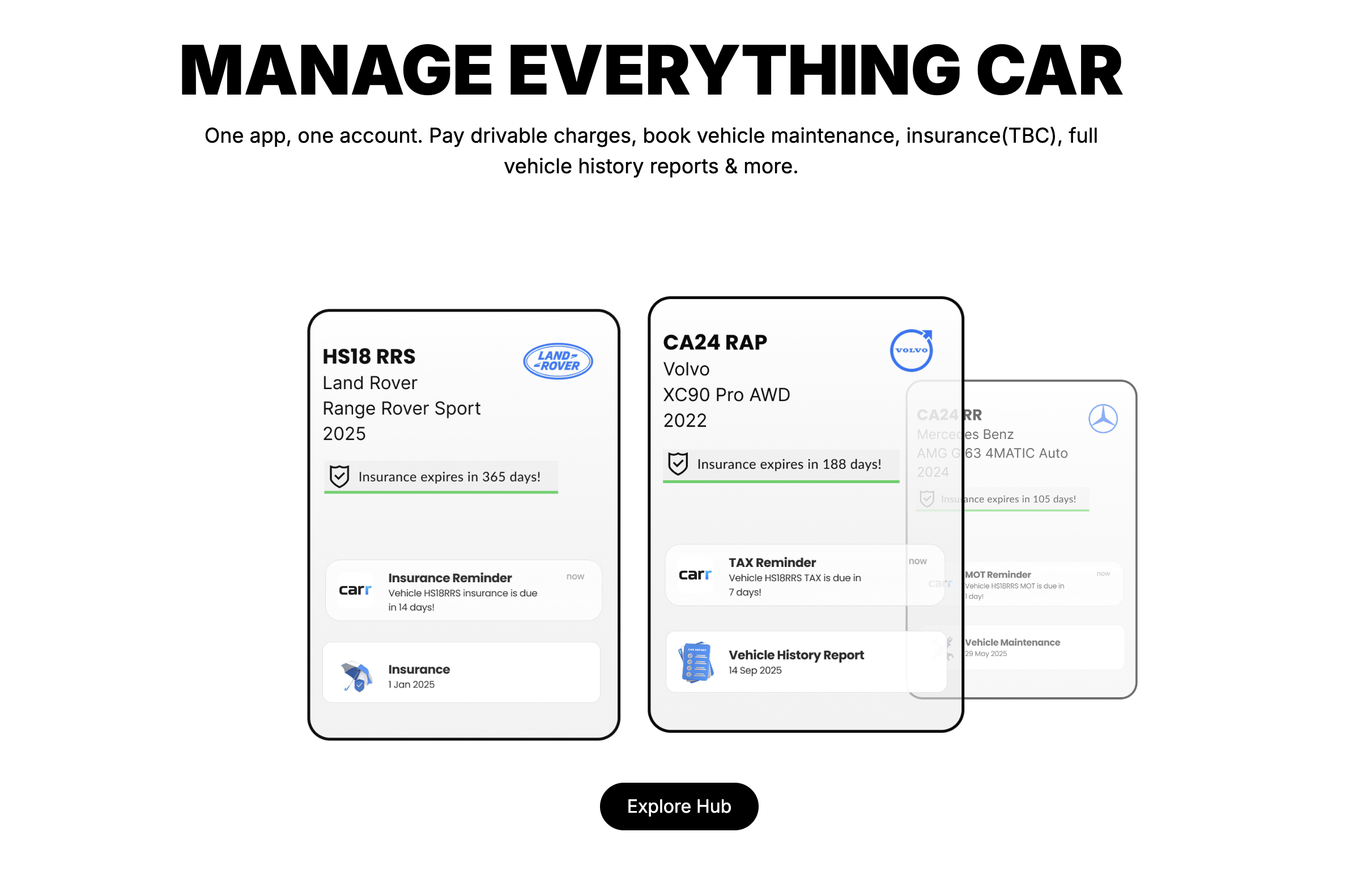

London-based Carr is a UK-based mobile platform and a team of 1. It just raised $1.9 million in seed funding.

The app claims to help drivers manage all aspects of car ownership in one place. Users can check and pay drivable charges (like ULEZ and congestion fees), book MOT and maintenance, view full vehicle history reports, and track vehicle-related finances. Insurance integration is planned for the future.

It brings to mind Caura and Caha — and those are red flags.

|

|

|

|

Coverager Research |

|

|

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

Now Hiring |

Foresight Risk & Insurance Services, Acuity Insurance, Galecki Search Associates, Main Street America Insurance, Mercury Insurance, Simply Business, The Hanover.

View all open positions. |

|

|

📬 Invite your friends to join the newsletter.

|

|

|

This Month on Coverager Data |