|

|

"Creating light and air where there isn't any, and creating the number of units that were created, it's just mind boggling."

– The nation's biggest office-to-residential conversion, which was originally built to house computers, is now complete.

|

|

|

Sponsored |

Taking the Next Step in Modernizing Your Billing System |

|

Effective billing management is more than just a necessity for insurers—it's a key driver of customer satisfaction and business growth. However, for many insurers, it's also a source of enormous costs and headaches.

In this new blog post, Matt Hamilton, Product Architect at Socotra, reviews the pitfalls of many existing billing systems and the four elements needed for better billing.

Read the blog.

|

|

|

2024 |

Progressive released its financial results for December, ending the month with a combined ratio of 84.1% and net income of $942 million.

In 2024, Progressive generated $8.48 billion in net income and achieved a combined ratio of 88.8%.

The insurer had ~34.95 million policies at the end of December, an increase of 18% compared to December 2023. During the month, Progressive added around 213k new policies to its overall count. In 2024, Progressive increased its total PIF count by ~5.2 million.

|

|

|

💰 |

|

UVeye, a provider of AI-powered vehicle inspection systems, announced $191 million in equity and debt. The $41 million in equity financing was led by Woven Capital, with participation from UMC Capital, MyBerg, W.R. Berkley, Menora Mivtachim, and More Investment House. Trinity Capital structured the $150 million debt facility.

Founded in 2016, UVeye's drive-thru systems, described as an "MRI for vehicles," leverage computer vision to conduct assessments of vehicle damage.

Last year, Acadia Insurance, a Berkley company, partnered with the Israeli startup to leverage its systems for the creation of insurance estimates.

|

|

|

|

Under consideration |

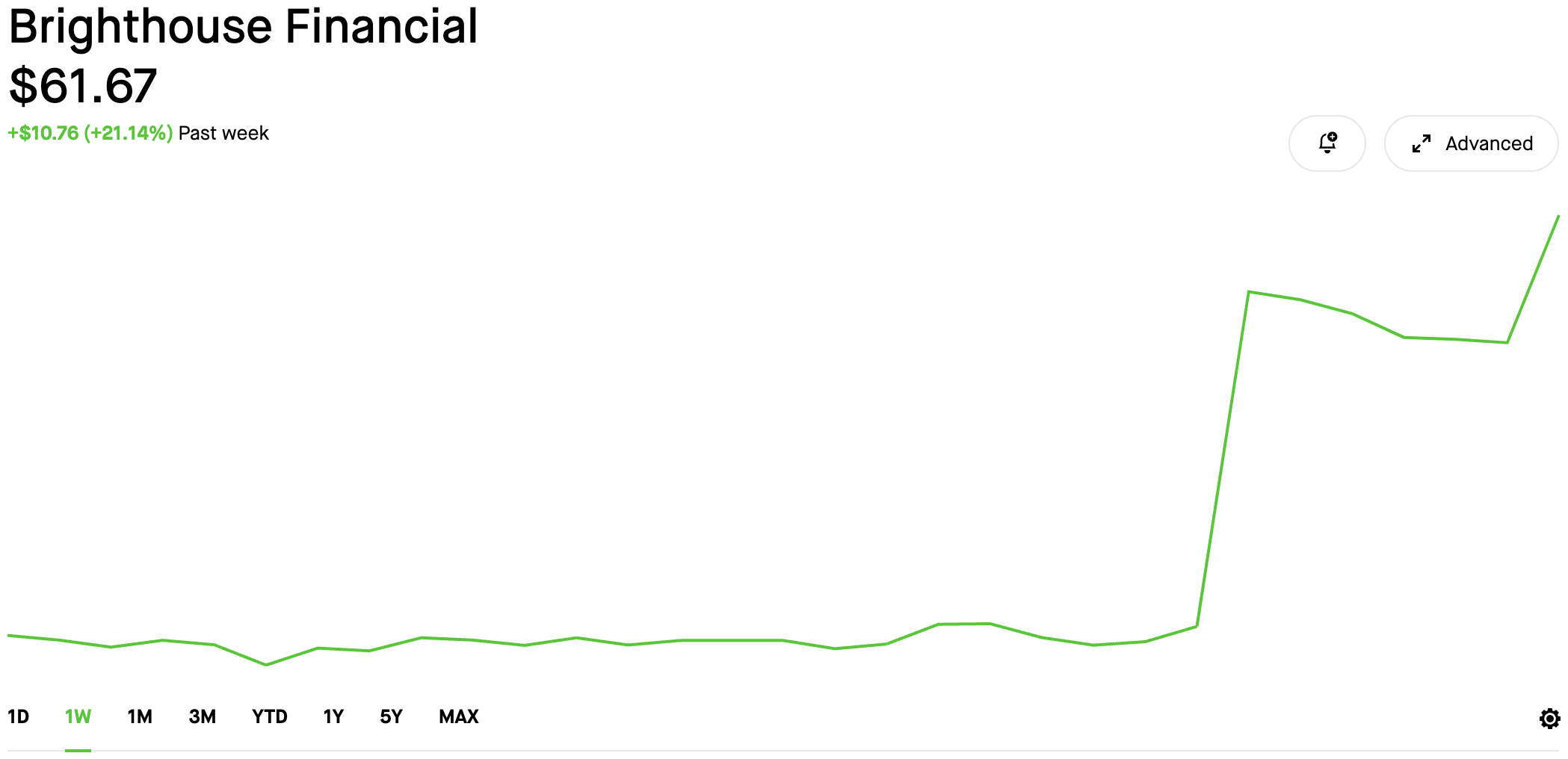

Brighthouse Financial, a provider of annuities and life insurance, is considering selling itself, the Financial Times reported.

The company, which spun off from MetLife in 2017, has a market value of $3.47 billion.

|

|

|

|

10 |

Ford Pro Insure, Ford's commercial auto insurance offering, is now available in Texas and Ohio. Currently, coverage is available in ten states – Arizona, Illinois, Tennessee, Indiana, Wisconsin, Minnesota, Maryland, Pennsylvania, Texas, and Ohio.

Policies are issued by The American Road Insurance Company, the carrier subsidiary of Ford Motor Company, and sold and administered by Pie Insurance.

|

|

|

K2 Credit |

K2 International, a division of K2 Insurance Services, announced the launch of K2 Credit. This new division will write comprehensive Non-Payment Insurance across Single Risk and Portfolios for businesses in the Non-Bank sector.

K2 Credit is backed by Lloyd's licensing (AA- rated) and led by QBE, with additional backing from Lloyd's of London syndicates.

|

|

|

In a word |

"Look, California is a difficult market for insurance companies, and it has only become more difficult over time. The state, along with the pressure it receives from consumer advocacy groups, suppresses the ability to charge a fair price for the risk and tailor coverages to improve availability and affordability of insurance for the citizens of the state. Insurers are unable to generate a reasonable risk-adjusted return commensurate with the risk of ensuring natural perils, such as wildfire, and the cost in California associated with reconstruction following a disaster.

This suppression of pricing signals, which are rising, encourages more risk-taking by individuals and businesses as to where they choose to live or work, and it encourages less risk management or loss mitigation activity. And they're part as well by federal, state and local governments. We all have a hand in loss mitigation activity that actually is occurring or not occurring. In a word, economics incent behaviors, and California is impacting those economic signals."

– Chubb CEO Evan Greenberg.

|

|

|

Another update |

Following yesterday's Re update, Re.xyz now redirects to coverre.com, and when you click 'invest now,' a US investor/non-US investor pop-up is displayed.

|

|

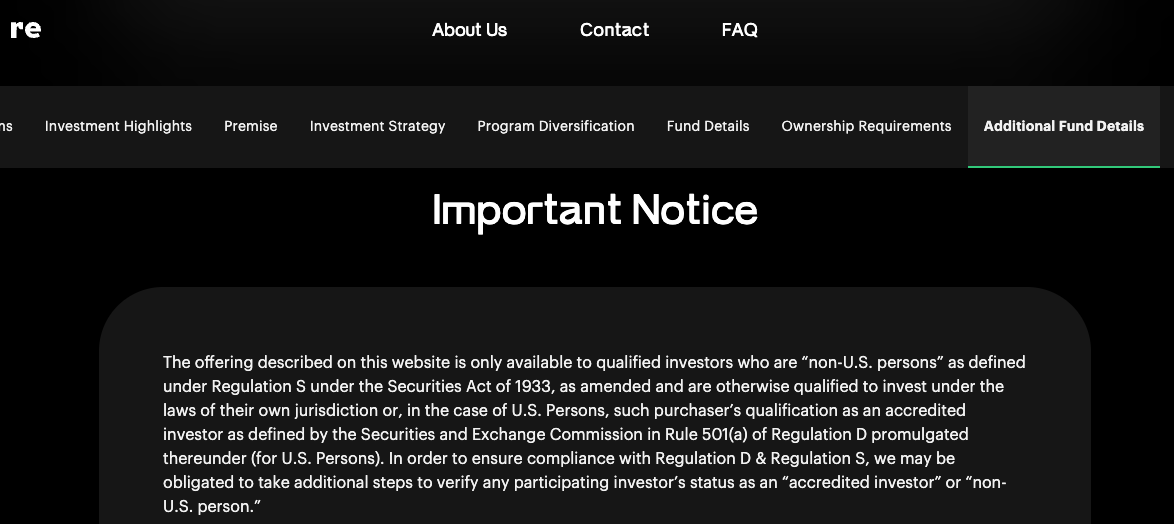

The bottom of the site features the following notice:

|

|

Confused about Re? So are we.

|

|

|

Now Hiring |

The Hanover, Travelers, Acuity Insurance, Galecki Search Associates, American Family Insurance, Berkshire Hathaway GUARD, Nationwide, Protective Life, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Alpharoot, Liberty Mutual, OneShield, Chubb. |

|

|

This Month on Coverager Data |

|

|