|

|

"A lot of the same: adapt, adapt, adapt."

- Cross River Bank CEO Gilles Gade, speaking this week about what's ahead for his bank in the next five years. He also emphasized efficiency, maintaining the same workforce size (not expecting to increase headcount), and achieving exponentially better infrastructure.

|

|

|

|

Read till the end

|

|

In October 2018, Driver, an app designed to match cancer patients with clinical trials, shut down after running out of money, resulting in the layoff of ~85 employees. The company had been attempting to raise another round of funding but failed to generate revenue quickly enough to secure the necessary capital, according to CEO and co-founder Dr. William Polkinghorn.

Polkinghorn is now leading Need, a San Francisco-based startup building what it describes as the "world's first cancer protection system." The company claims to assist individuals across three phases—prevention (Wellbeing Mode), diagnosis and treatment (Treatment Mode), and recovery (Recovery Mode)—using tools such as personalized health insights, treatment recommendations, and post-treatment guidance.

*** What if Javen Xu, a founding member of the AI and Data Science team at Need as of May 2024, leverages her connections at Lincoln Financial to position Need as a value-added service?

|

|

|

Monarch by Virtus |

Virtus was appointed by Redwood Fire and Casualty Insurance Company, a Berkshire Hathaway company, this month.

ICYMI: Monarch by Virtus is an insurance platform tailored for small businesses and individuals. If you look closely, you'll see Indio.

Virtus is an insurance brokerage and consulting firm founded in 2013. "It starts above a pizza shop in 2013...."

|

|

|

|

|

Alternative distribution |

|

Home and financial services platform Just Move In has appointed James Pilkington as Category Lead for Insurance. Pilkington will focus on enhancing Just Move In's insurance offerings to support clients during and after the home-moving process.

Founded in 2015, Just Move In has raised over $9 million to simplify the moving process through its Home Setup, Utility Management, and Void Energy technology. The company also offers API solutions for FinTechs and PropTechs, along with CRM integrations for estate and letting agencies.

|

|

|

🎉🏆🎂 Milestones |

-

Trupanion recently surpassed $3 billion in payments to veterinarians and pet parents.

-

HiRoad started selling policies in Rhode Island in November 2017. It had ~4k policies in force in the state as of February 29, 2024.

|

|

|

|

Estimating tool |

Mitchell International and Collective Now launched a virtual estimating service for US auto insurers, enabling claims processing through photo-based estimates powered by Mitchell's tech.

Collective provides a remote platform where individuals with auto claims experience can complete auto damage reports online, earning $8 per completed job.

"The use of our on-demand estimating service with Mitchell's technology can help carriers exceed consumers' digital delivery expectations for far less expense than traditional appraisal methods." - Jeff Waack, Managing Director at Collective Now. Waack used to work at Allstate.

|

|

|

Life tool |

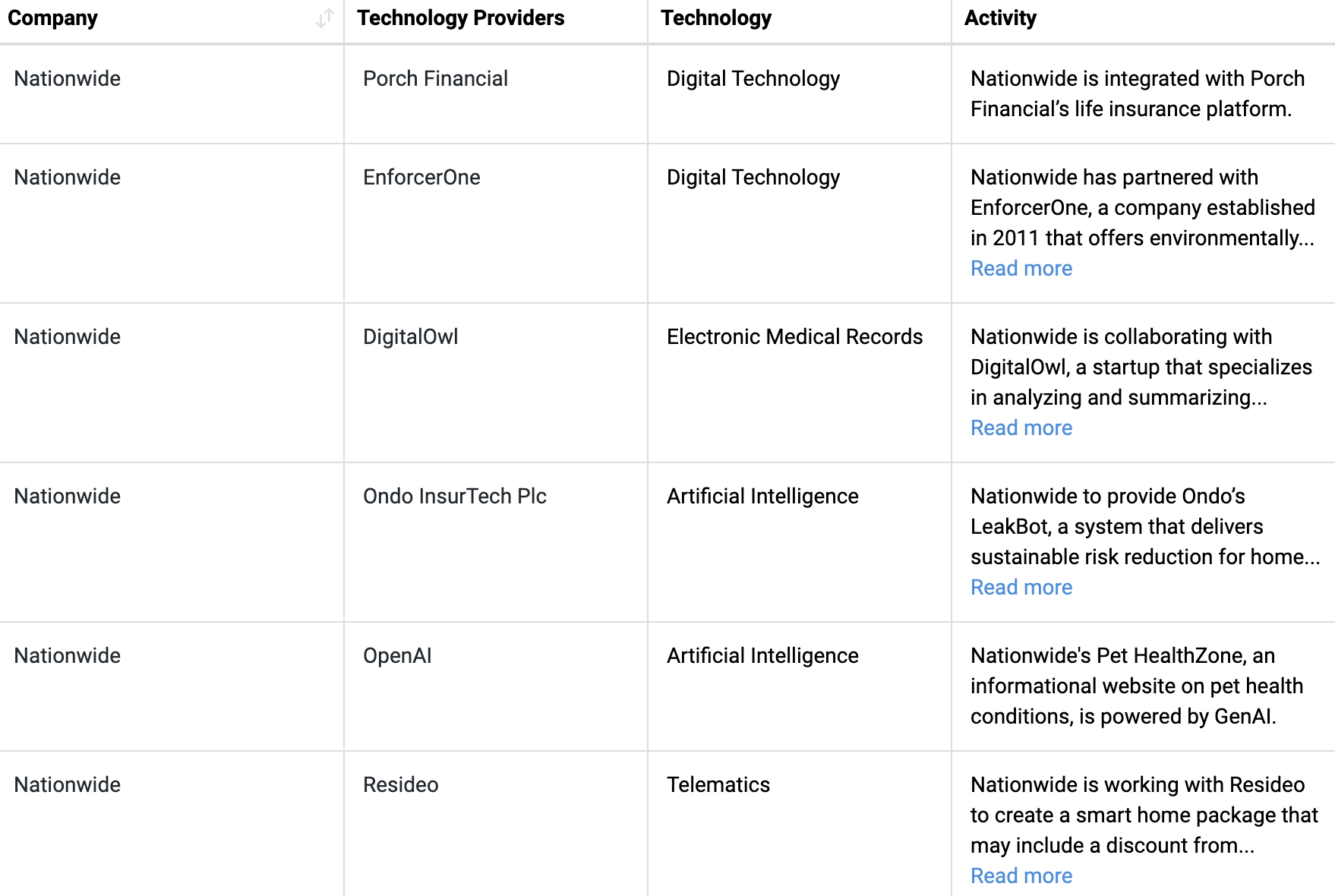

DigitalOwl partnered with ExamOne to improve medical record retrieval and analysis for life insurance and legal clients by combining its AI-powered platform with ExamOne's expertise in records and underwriting.

Nationwide is a client.

|

|

On a related note, Wisedocs, a machine learning SaaS platform specializing in medical record review, has increased its IT headcount by 200% over the past year, according to LinkedIn 'hiring & headcount' insights.

|

|

|

🚩 |

|

Lerer Hippeau no longer lists Ranger in its portfolio, and LinkedIn shows three employees.

Ranger raised $5.25 million in 2022 to sell home insurance through independent agents but later shifted to a B2B model with Ranger Station, a platform designed to help agencies scale and enhance customer relationships.

|

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

Latest From Coverager Research |

|

Become a client. |

|

|

Now Hiring |

American Family Insurance, Galecki Search Associates, Great American Insurance Group, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Progressive, Auxo Solutions, Federato. |

|

|

This Month on Coverager Data |

|

|

|

|

|

|

|

|

|

|

|

|