|

|

"The crazies have taken over, to be honest."

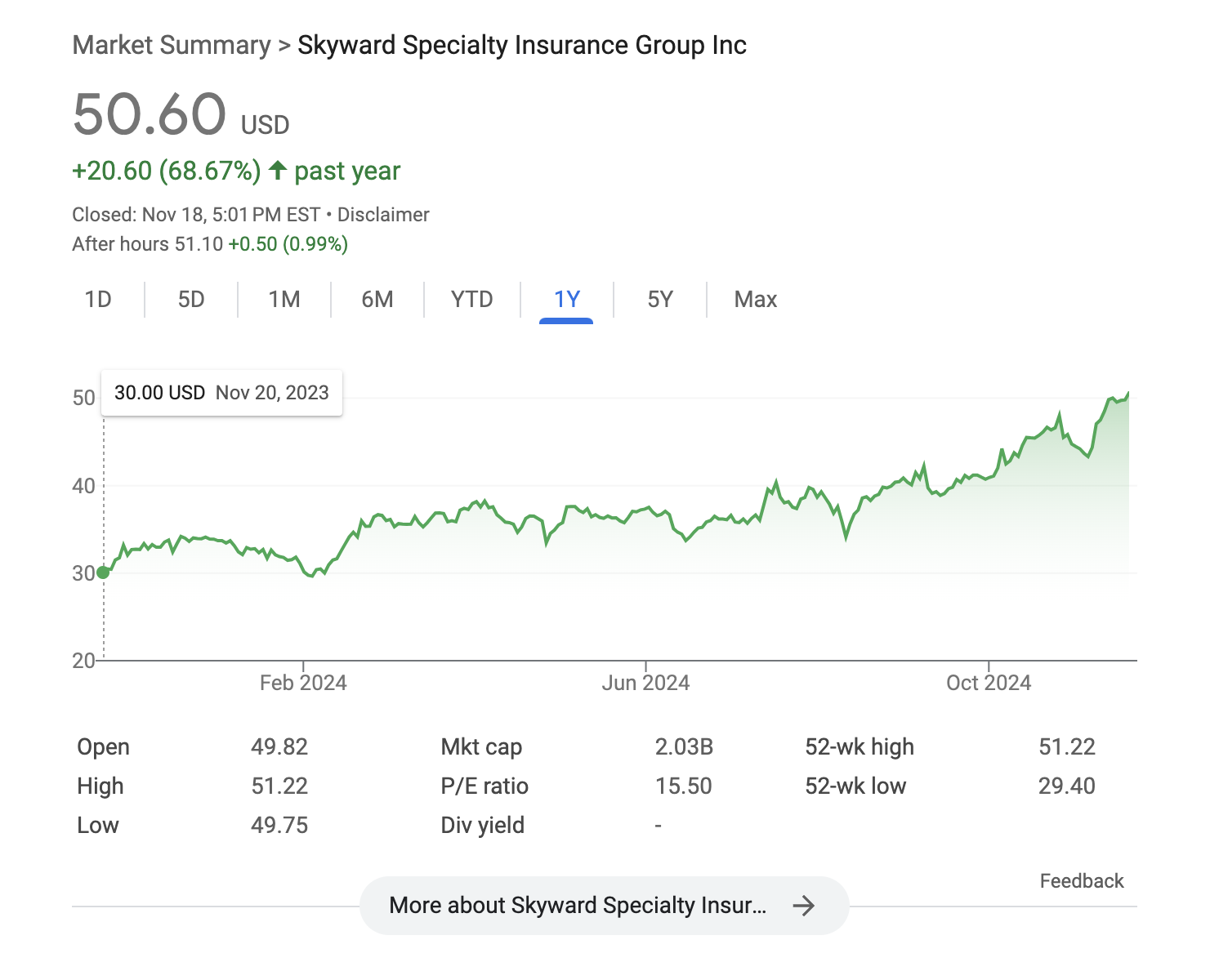

– Skyward Specialty CFO Mark Haushill. For context, the company hosted its earnings call on October 30, 2024, as it nears its second year as a public company, sharing that gross written premiums rose 12.4% to $400 million, with key contributions from A&H, surety, and agriculture. While focusing on disciplined growth under its "Rule Our Niche" strategy, Skyward highlighted successes like the Media Liability unit's launch but also addressed reckless pricing in the Global Property market👆.

|

|

|

|

$ |

State Farm released the Q3 2024 financial results for 12 of its P&C insurance carriers.

During the quarter, the group of companies reported a net underwriting loss of ~$4 billion, leading to an underwriting loss of ~$8.3 billion for the first nine months of the year. During the first nine months of 2023, State Farm reported a net underwriting loss of $12.5 billion.

State Farm's auto carrier saw the biggest improvement, going from a loss of $8.2 billion in the first nine months of 2023 to a $3.3 billion loss for the same period this year. The auto carrier increased written premiums by ~$7.57 billion (18%) YoY to a total of $48.8 billion.

In 2023, State Farm had a combined underwriting loss of $14.1 billion across its P&C companies, but it ended the year with a net loss of $6.3 billion thanks to investment income and positive results from its life insurance business.

|

|

|

Growing |

|

General Motors Insurance is now offering car insurance in Alabama, Iowa, and Tennessee, bringing coverage to a total of 11 states.

GM National Insurance Company, the carrier subsidiary of GM, recently published its Q3 results. For the first nine months, the carrier reported $12.3 million in written premiums and a net underwriting loss of $41 million following $14.6 million in losses and loss adjustment expenses and $34 million in other underwriting expenses.

|

|

|

Responsive |

Progressive is bringing its safety feature, Accident Response, to customers nationwide.

If a crash is detected, Progressive will reach out to the driver to see if help is needed. The driver can then request emergency services or a tow truck through the app or with a live agent. If they don't respond, and the accident appears severe, emergency services will be dispatched to the crash location. If tow or emergency services are requested, Progressive will automatically submit a claim on the customer's behalf.

Accident Response is not available in California.

|

|

|

Home insights |

|

Porch Group Media, the data and marketing subsidiary of Porch Group, has signed an agreement to license non-exclusively its Home Factors insights to California-based MGA Bamboo Insurance.

This agreement follows the recent announcement of Home Factors' official third-party launch in the market. Porch Group Media has Home Factors for approximately 90% of US homes, providing "unique and valuable insights not previously available."

According to its site, Home Factors can provides insights regarding the type of piping, status of electrical systems, and flooring, among other things.

|

|

|

🤝 |

Small business insurance broker Simply Business announced a new partnership with First Connect Insurance Services.

First Connect's network of appointed agents now has a single access point to Simply Business's suite of digital insurance products.

|

|

|

🗽 |

Toronto-based digital broker Foxquilt is now available in New York.

"We're excited to work alongside our agency and enterprise partner network to empower New York businesses to thrive with confidence." – Josh Reznick, Chief Distribution Officer at Foxquilt.

|

|

|

Trust ? & Will |

|

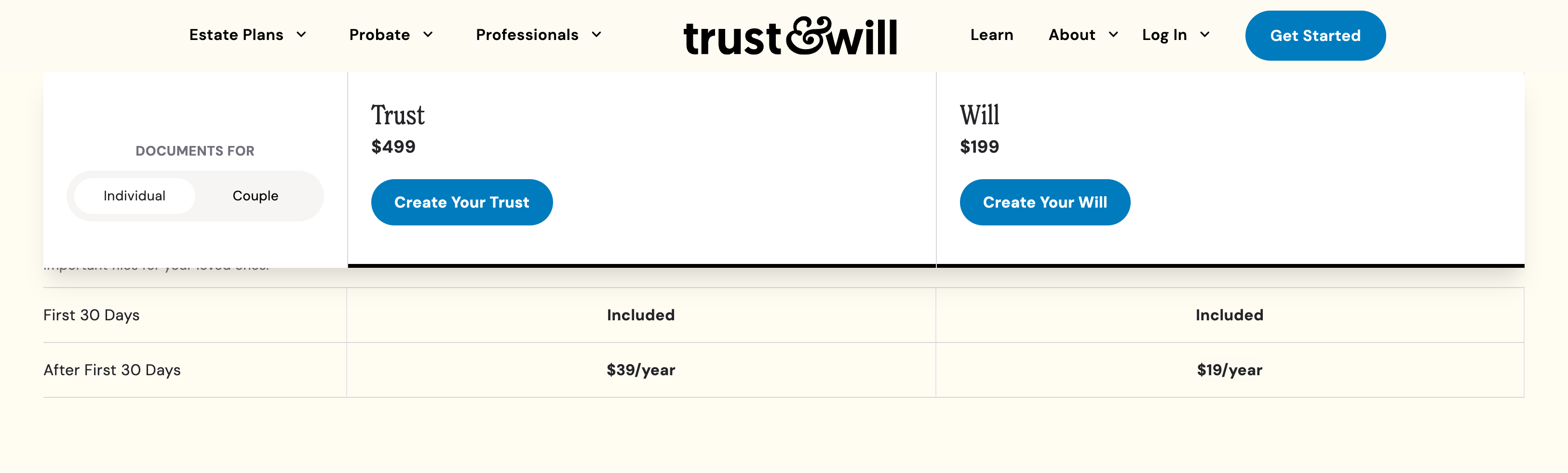

This year, Erie Strategic Ventures invested in Trust & Will, which previously attracted attention from Northwestern Mutual Future Ventures and USAA. According to Glassdoor reviews, new executives are in, layoffs are constant, but some claim the "team is better and stronger now that tough decisions had to be made."

Time will tell whether it's 'a sinking ship with terrible management.'

|

|

|

Making a point |

"There are some people out there that think that we're a retail business. And I would say that we are a diversified insurance broker because 58% of our revenue is Retail, but for everybody else that maybe isn't getting it, that's 42% other than Retail. And that part of our business performed really well."

– CEO Powell Brown, Jul 26, 2022.

"There are some people out there that really don't, I don't think, fully understand or give us credit for the other than Retail part of our business, which is 40% of the revenue. And as you know, it is performing very nicely. So if you want to look at it on a slightly different perspective, and I know you've already thought about this, but if you look at the performance of wholesale and programs together, that 40% grew at 17.7% in Q3. Pretty impressive."

– CEO Powell Brown, Oct 29, 2024.

|

|

|

|

Watch out – they have over 700k interested folks. |

|

|

Member Content |

|

|

|

BECOME A MEMBER

|

|

|

Latest From Coverager Research |

|

Become a client. |

|

|

Now Hiring |

American Family Insurance, Galecki Search Associates, Great American Insurance Group, Nationwide, The Hanover, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: The Zebra, Earnix, Arizent, InsureMO, Liberty Mutual, Noldor. |

|

|

This Month on Coverager Data |

|

|