|

|

"Goosehead is trading at approximately 14 times its annual revenue – that's more than Google and Progressive. Geese are known for their ability to fly long distances, but this goose is in the business of trying to teach others how to fly."

– Goosehead is talking about embedded insurance. |

|

|

No match |

|

Trucking insurance startup Nirvana Insurance announced an $80 million Series C funding round, valuing the company at nearly $850 million. The round was led by General Catalyst with continued support from existing investors Lightspeed Venture Partners and Valor Equity Partners.

Founded in 2021, the California-based startup has now raised ~$160 million and it claims to have produced more than $100 million in premiums.

"Our technology integrates an exceptional breadth of data from sensors and across the insurance ecosystem. By harnessing this data with our suite of specialized AI models—from predictive analytics to large reasoning models—we deliver what matters most: more accurate pricing, faster claims resolution, and a dramatically simpler experience for our customers that traditional insurers simply cannot match." – Nirvana Co-Founder and CTO Abhay Mitra. |

|

|

Rocket + Redfin |

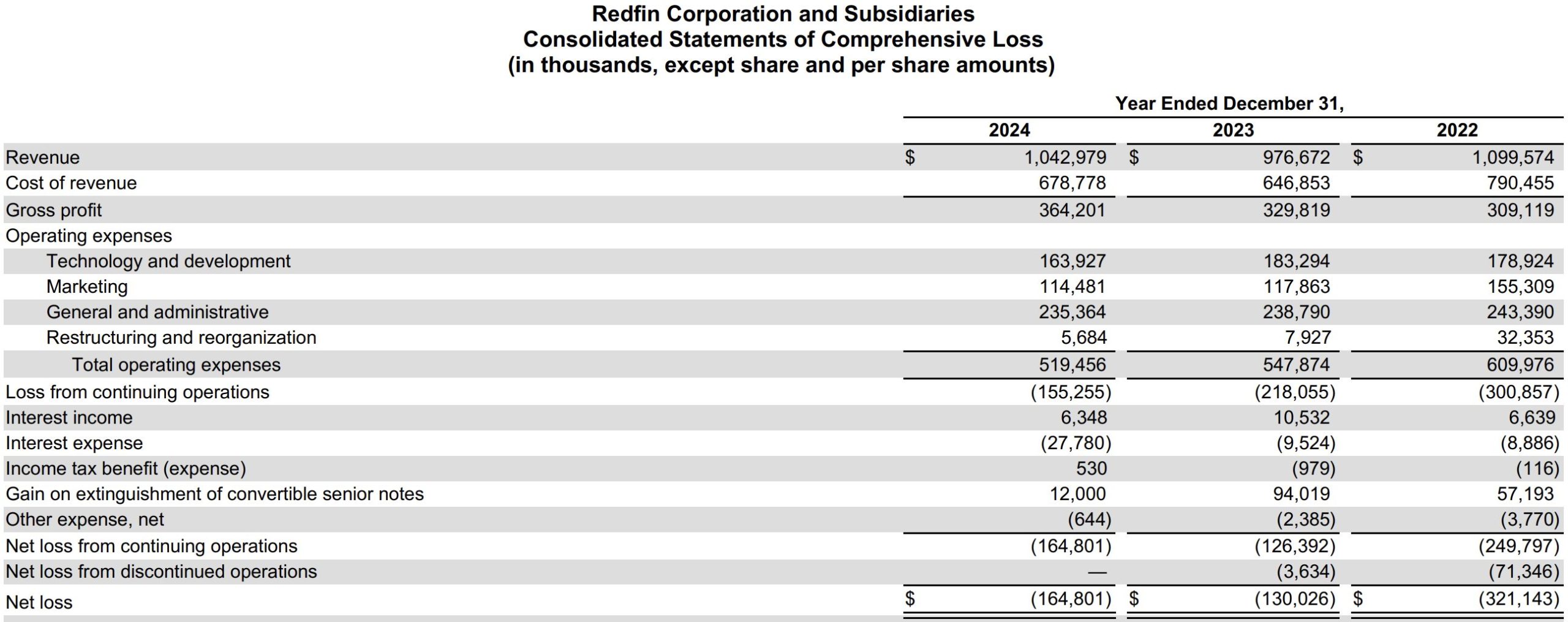

Rocket Companies, the platform consisting of mortgage, real estate and personal finance businesses, has entered into an agreement to acquire digital real estate brokerage Redfin in an all-stock transaction for a value of $12.50 per Redfin share, or $1.75 billion of equity value.

Founded in 2004, Redfin operates a top-three home search platform with more than 1 million for-sale and rental listings and a tech-powered brokerage of more than 2,200 agents. Rocket Companies will benefit from Redfin's nearly 50 million monthly visitors and the transaction will generate "significant revenue synergies" across search, real estate brokerage, mortgage origination, title and servicing.

Redfin reported significant losses in the past few years. The company's brokerage model is different – instead of agents working as independent contractors, Redfin employs agents and provides them with health insurance and other benefits as well as the opportunity to earn equity compensation. The company claims that in 2024, Redfin agents earned a median income that was more than two times as much as agents at competing brokerages. |

|

"Rocket and Redfin's approaches to lending and brokerage service have always been two halves of one vision to make the whole home-buying process magical. We want a customer to be able to check her phone to find out what she can afford, see which homes are just right for her, schedule a tour with a local, expert Redfin agent, and get pre-qualified for a loan, all in a matter of minutes." – Glenn Kelman, CEO of Redfin. |

|

|

New partner |

Google is replacing Assurant with Asurion as the coverage provider for its Pixel Preferred Care plans.

Starting February 24, 2025, all Pixel devices with a Preferred Care plan will have service contracts managed by Asurion Warranty Protection Services instead of Assurant. The Preferred Care plan offers coverage beyond Google's standard warranty, including mechanical breakdowns, accidental damage, and screen repair services.

Assurant has been Google's partner for mobile protection since at least 2015, when its CEO, Alan Colberg, highlighted the collaboration as a key step in expanding the company's Connected Living strategy.

"At Assurant Solutions, we launched new mobile protection programs with Google and Samsung. While the programs will start small, these partnerships represent important steps in our global expansion of Connected Living." – Colberg, Oct 2015.

Colberg retired in 2021.

Meanwhile, Samsung Care+ is administered by Servify and backed by AmTrust Financial in the US.

Bottom Line: Assurant's Connected Living division is dependent on a handful of large telecom partners, making renewals crucial. |

|

|

$ |

|

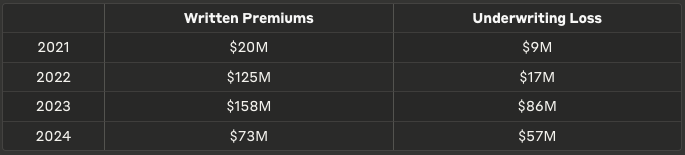

Branch Insurance Exchange, the reciprocal managed by insurance startup Branch, has released its 2024 results, ending the year with $73 million in written premiums, a 54% decrease compared to 2023.

The reciprocal reported a net underwriting loss of $57 million for the year, compared to a loss of $86 million in 2023.

In the filing for December 31, 2023, the management of the reciprocal determined that there is substantial doubt about its ability to continue as a going concern due to the company's recurring losses since inception. Management has provided an update that as of December 31, 2024, the reciprocal had met the capital requirement and required no capital support from Branch Financial. "The company continues to improve its operational results and has materially reduced its exposure to catastrophe losses such that it does not foresee the need for substantial capital support from Branch Financial, LLC into 2025." |

|

|

Preliminary |

Lloyd's has shared preliminary 2024 full year financial results:

Gross Written Premium increased by 6.5% to £55.5 billion (FY 2023: £52.1 billion) reflecting 8.5% growth, primarily in the property and reinsurance segments which had a strong underwriting performance in the year, 0.3% price change and FX movements of (2.3)%. The market's combined ratio is 86.9%, an increase of 2.9 percentage points from the prior year (FY 2023: 84%), driven by major claims in the second half of the year. Excluding large losses, the underlying combined ratio is 79.1% (FY 2023: 80.5%). The attritional loss ratio improved to 47.1% reflecting continued underwriting discipline (FY 2023: 48.3%), while the expense ratio remained flat at 34.4%(FY 2023: 34.4%). The investment return is £4.9 billion (FY 2023: £5.3 billion), with the portfolio benefitting from another year of high interest rates, notwithstanding some market volatility in the fourth quarter. Underwriting profit is £5.3 billion (FY 2023: £5.9 billion) and profit before tax is £9.6 billion (2023: £10.7 billion). Lloyd's expects approximately $2.3 billion in losses from the California wildfires. |

|

|

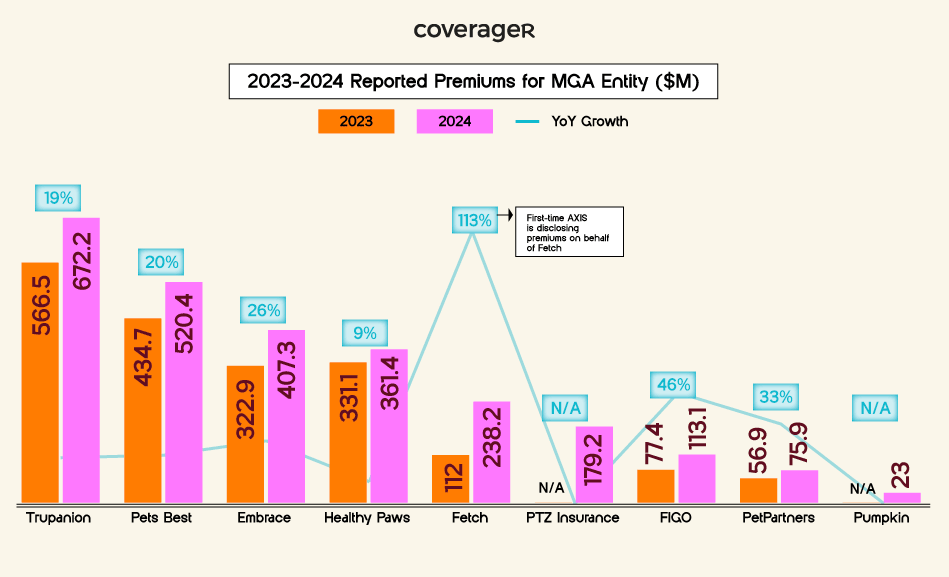

Coverager Research |

|

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

Now Hiring |

Obie, Arch Insurance Group, Berkshire Hathaway GUARD, Galecki Search Associates, Mercury Insurance, The Hanover, Travelers. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: PinchLab, USAA, Clearspeed, Skarzynski Marick & Black, IMS. |

|

|

This Month on Coverager Data |

|

|