|

|

"Southwest experienced great success adhering to one business model for a bunch of years, and then the world around them changed and they didn't really adapt."

– The NY Times.

|

|

|

Substantial doubt |

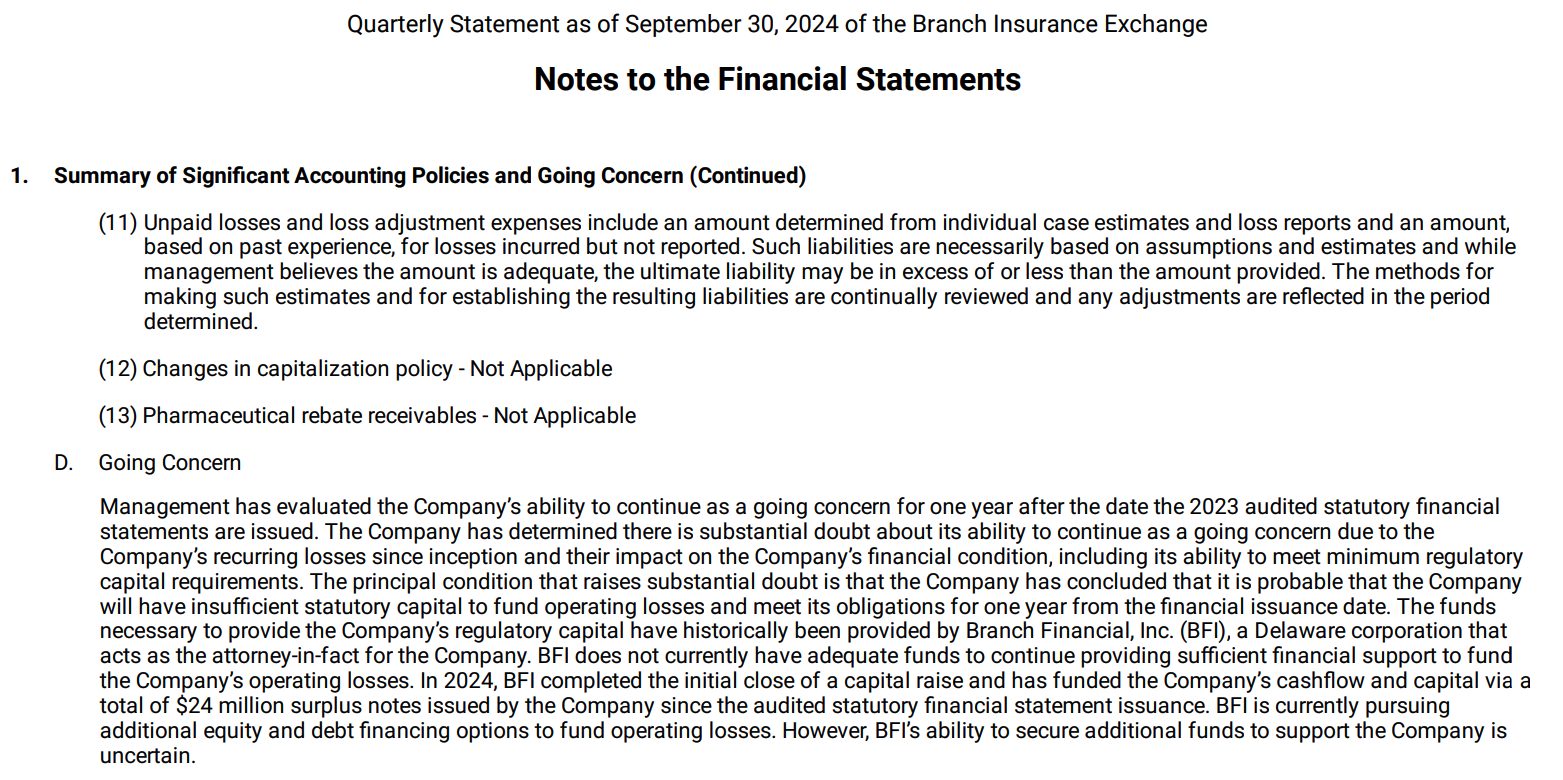

Branch Insurance Exchange, the reciprocal managed by insurance startup Branch, has released its Q3 2024 results, ending the first nine months with $54 million in written premiums, a 58% decrease compared to the same period last year.

The reciprocal reported a net underwriting loss of $50.7 million for the first nine months of the year, compared to a $70.6 million loss for the same period last year. In 2023, the reciprocal reported a net underwriting loss of $85.5 million.

In the filing for December 31, 2023, the management of the reciprocal determined that there is substantial doubt about its ability to continue as a going concern due to the company's recurring losses since inception. Last month, The Insurer reported that Branch raised $51 million, but according to the Q3 filing, the reciprocal's future is still in doubt.

|

|

|

|

🇯🇵 |

Japanese insurance startup justInCase is being acquired by Sony Financial Group, which is owned by Sony.

Founded in 2016, justInCase distributes a variety of insurance products such as one day injury insurance and one night hospital coverage.

Sony Financial Group, which operates in P&C and life, aims to expand its insurance business by entering the small-amount, short-term insurance business.

justInCase publicly disclosed ~$11 million in funding.

|

|

|

Another acquisition |

Bishop Street Underwriters, a RedBird Capital Partners portfolio company, will acquire Landmark Underwriting, a specialty focused managing general agent in the London Insurance market.

This acquisition follows a series of key strategic developments, including the acquisitions of Ethos Specialty's Transactional Liability unit, Conifer Insurance Services, Ahoy!, an investment in Verve Services, and the establishment of partnerships with Skyward Specialty Insurance and Topsail Re.

|

|

|

🚩 Hiscox 🤝 Livlet |

|

Previously, we reported on the partnership between home management platform Livlet and Hiscox, which offered home insurance customers a 10% discount for using Livlet.

Currently, Livlet's operational status is uncertain. The site lacks a sign-up option, and emails to the company are bouncing back.

|

|

|

|

Change management |

After nine years with Cinch Home Services, Steve Upshaw has transitioned to CEO of HomeTown Services.

Cinch appointed Sharena Ali as its new CEO. Previously, Ali was President at CONNECT, powered by American Family Insurance, overseeing over $1 billion in customer premiums. She has also held senior roles at Homesite Insurance, AIG, Travelers, and Progressive, focusing on technology adoption, product development, and building successful partnerships.

|

|

|

New entrant |

|

Founded in 2023, Swiss startup Poncho has raised over $600,000 in seed funding from WeBuild Ventures. Poncho provides automatic refunds for outdoor experiences disrupted by bad weather, using an API-integrated weather guarantee solution.

The company operates in the same space as Sensible Weather, a Santa Monica-based parametric insurance startup that has raised $16 million since its inception.

|

|

|

Winter sale |

In November 2023, we reported that USAA partnered with Roost to offer its 13+ million members the Roost Security360 Solution, a nine-piece home security system with 24/7 professional monitoring. Members could access the system under a 36-month agreement for $21/month.

Now, there's a special offer for USAA members:

|

|

|

|

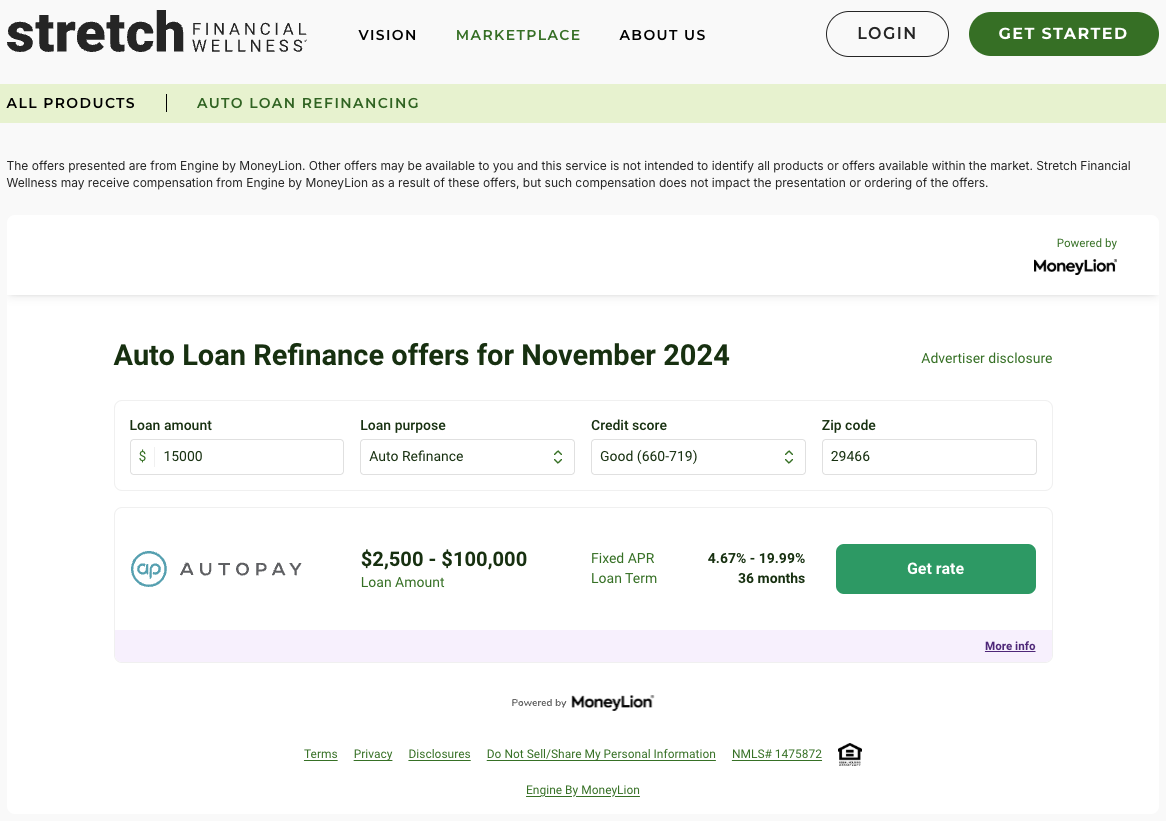

New marketplace |

Progressive's Stretch Financial Wellness has launched a marketplace for financial products powered by MoneyLion.

|

|

|

|

Latest From Coverager Research |

|

Become a client. |

|

|

Now Hiring |

Tint, merican Family Insurance, Galecki Search Associates, Great American Insurance Group, USAA. View open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Virtus, Travelers, PolicyBound, Federato, Daman Associates, Nirvana, Affordable American Insurance, Obie Insurance. |

|

|

This Month on Coverager Data |

|

|