|

|

"But the business of TVs is changing and TV sales changing pretty dramatically. And this is the other dimension. So it used to be you would buy a TV for a wholesale price, you would sell it for a retail price. and that would be the business. That would be the revenue that we would generate. But increasingly, the hardware is less important than the software, the operating system that sits in the television. And when the customer brings the TV home and puts it on the wall or on a shelf or somewhere in the kitchen, let's say, when they turn on the TV, that technology and those operating systems allow for a better experience. They're allowed -- advertisers are allowed to speak to the owners of those TVs in ways that are more prescriptive, so they get better, more relevant advertising. And then the technology itself, that operating system that a customer uses allows them to discover new content, could be content from different streaming companies. So those streaming companies or the studios will advertise to customers to say, "Hey, watch my show, for instance. So there's a big business there that sits in the technology and the operating system that's inside the TV that's quite different, and we now have an option to play in that market. We're really excited about it."

– Walmart.

|

|

|

Sponsored |

Lower Distraction Prevented 105,000 Crashes Last Year |

|

In a new report, Cambridge Mobile Telematics reveals distracted driving fell 8.6% in 2024—the second year in a row it's dropped.

The impact: 105,000 fewer crashes, 59,000 fewer injuries, 480 lives saved, and $4.2 billion in economic losses avoided.

What's driving the shift? Growth in usage-based insurance, stronger hands-free laws, and rising public awareness.

See what's changing—and why it matters for every driver on the road.

Download the report preview

|

|

|

🤝 💰 |

Lincoln Financial announced a strategic growth investment of $825 million from Bain Capital, which will own a 9.9% stake in Lincoln Financial.

As part of the transaction, the companies have agreed to enter into a 10-year, non-exclusive strategic investment management relationship, with Bain Capital becoming an investment manager across a variety of asset classes including private credit, structured assets, mortgage loans, and private equity. This partnership provides Lincoln with access to a sustained source of high-quality private asset classes with differentiated risk-adjusted returns that enhance Lincoln's existing multi-manager platform.

"Today's announcement marks a pivotal milestone for Lincoln and highlights our commitment to delivering long-term value for our stakeholders. This partnership aligns us with a highly reputable organization whose powerful platform and shared values and goals will enable us to accelerate the execution of our strategy. We are extremely pleased with the strategic and financial benefits of our mutual capabilities and believe this partnership positions us for future success." – Ellen Cooper, Chairman, President and CEO of Lincoln Financial.

|

|

|

Sponsored |

Study: 37,000 Hours Saved With Accounting Automation |

|

How are leading insurance companies saving money? Simple, smart accounting automation. This quick read highlights how they save time while making payments easier for payers.

Get the case study.

|

|

|

Retiring |

The Liberty Mutual Board of Directors elected Timothy M. Sweeney Chairman of Liberty Mutual Holding Company, effective April 9, 2025. Sweeney, who is currently the company's President and CEO, will succeed David H. Long, who is retiring as Chairman and Director.

|

|

|

🏎 Powered by Hagerty |

The Hanover partnered with Hagerty to launch Hanover Collector Car, a classic car insurance product combining The Hanover's account protection with Hagerty's collector vehicle expertise.

Coverage (underwritten by Hanover) is available through independent agents in Michigan and Illinois, with plans to expand.

"We believe protecting customers' most precious assets with one carrier is critical in helping them gain true peace of mind. The Hanover's relationship with Hagerty allows us to strengthen our total account offerings and ease of doing business, with the outstanding claims experience our customers expect – backed by experts who really understand this unique market. It's the best of both worlds." – Brad McCreedy, vice president of personal lines strategy at The Hanover.

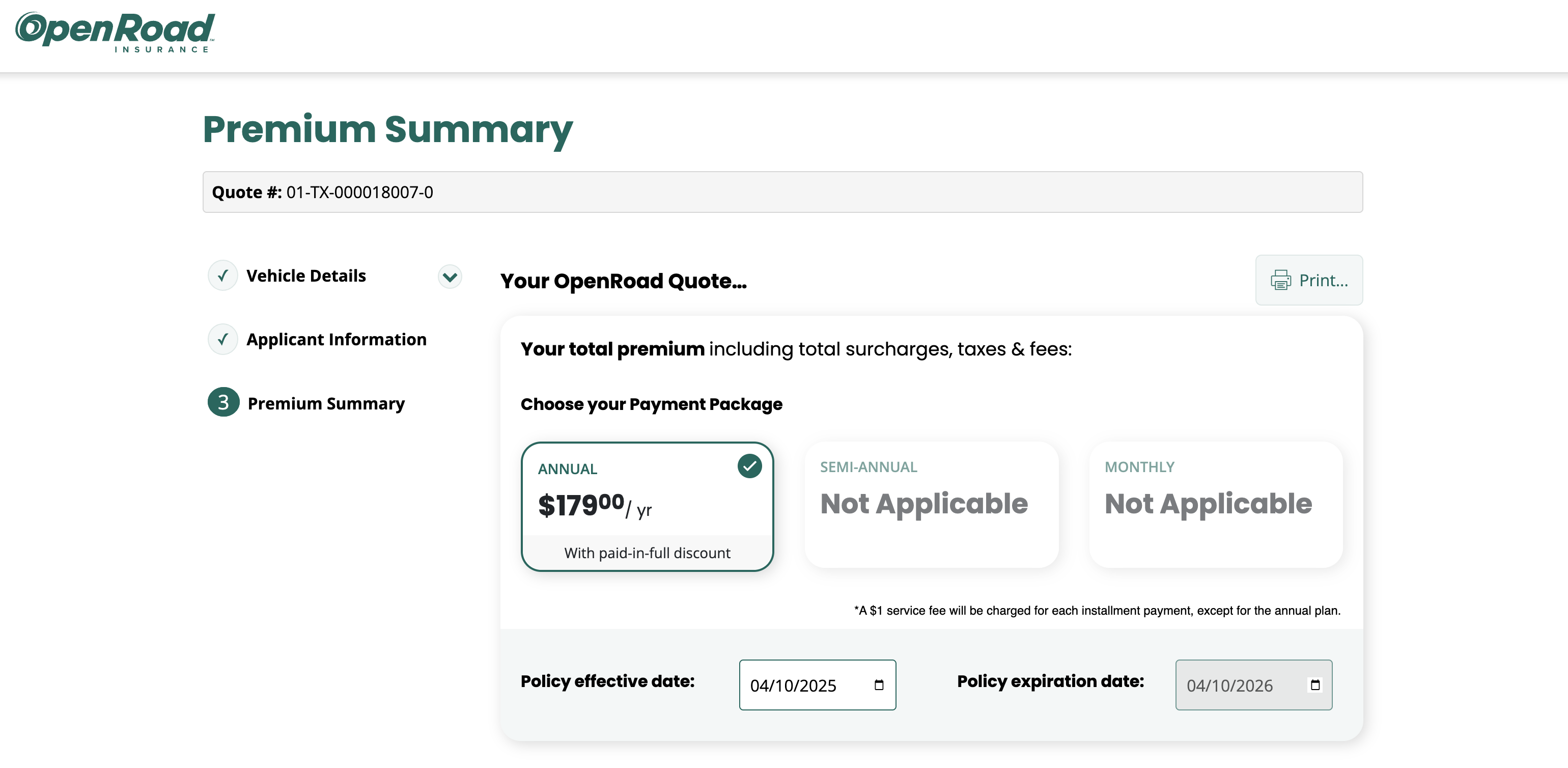

Bottom Line: If you know OpenRoad Insurance and its insurer partner, don't click here.

|

|

|

|

Life manager |

|

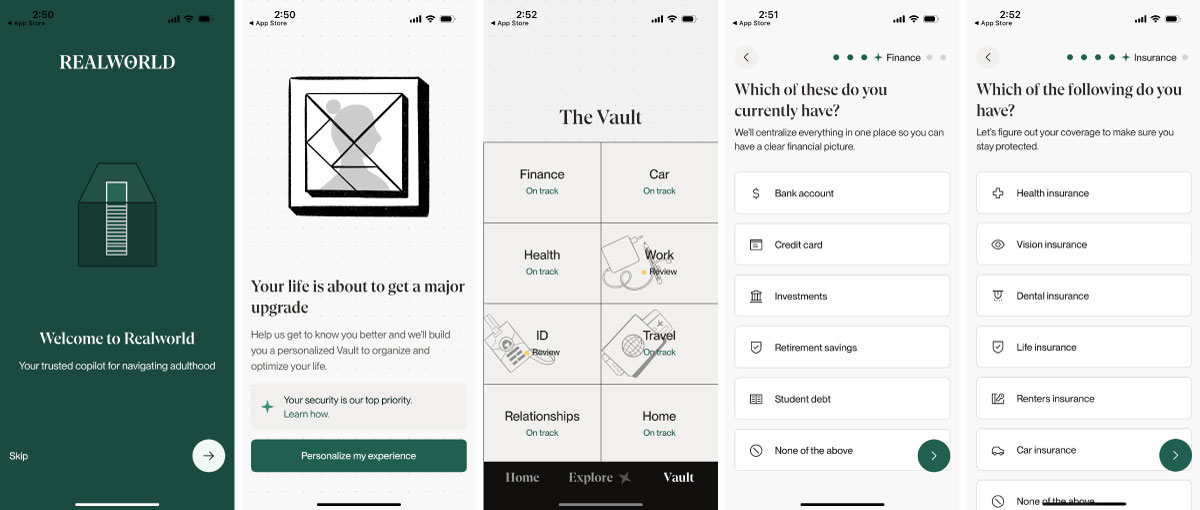

Realworld relaunched last month. We first covered the company in 2022, when it offered a library of "playbooks" to help users manage finances, healthcare, living situations, insurance, and more. At the time, we focused on its insurance angle, which primarily promoted car insurers.

The new app introduces a "vault" organized into sections: Finance, Car, Health, ID, Relationships, Work, Travel, and Home.

Bottom Line: The print doesn't match the process.

|

|

|

Money manager |

|

Alinea, a wealth management platform targeting Gen Z, raised a $10.4 million Series A round led by Play Ventures. GFR Fund, Y Combinator, Gaingels, FoundersX, F7, and Visible Ventures also participated.

Founded in 2021, the NY-based startup reports over 1 million users—92% of whom are women and 70% Gen Z. For $120/year, members get access to automated investing, financial education, 1:1 support, and a 650k-strong investor community... and you know what they say about communities — easy to say, hard to define, and even harder to build.

|

|

|

🚗 Prime time |

Zoox, Amazon's autonomous vehicle unit, has started testing its robotaxis in Los Angeles, marking its sixth testing location alongside San Francisco, Las Vegas, Seattle, Austin, and Miami.

The company is deploying a small number of retrofitted test vehicles, each with a safety driver, to manually map the area before launching autonomous operations later this summer.

Amazon acquired Zoox in 2020 for over $1.2 billion after the startup raised nearly $1 billion in funding.

In other autonomous news, Jim had a good ride.

|

|

|

👀 New tool |

|

VibeStack is a curated directory platform focused on discovering and organizing AI and developer tools.

|

|

|

🪞Then and now |

|

|

|

|

|

|

Member Content |

|

|

| BECOME A MEMBER |

|

|

Coverager Research |

Tomorrow's report will feature Spoudaios, Kinsend, SoFi, and more. |

|

|

Now Hiring |

Acuity Insurance, Foresight Risk & Insurance Services, Galecki Search Associates, GradGuard, Main Street America Insurance, Mercury Insurance, Simply Business, The Hanover.

View all open positions. |

|

|

📬 Invite your friends to join the newsletter.

Recent subscribers: Hexure, Solera, Guardian Life, Travelers, Samsung, Lyft, Tokio Marine. |

|

|

This Month on Coverager Data |

|

|