| Bloomberg Evening Briefing Americas |

| |

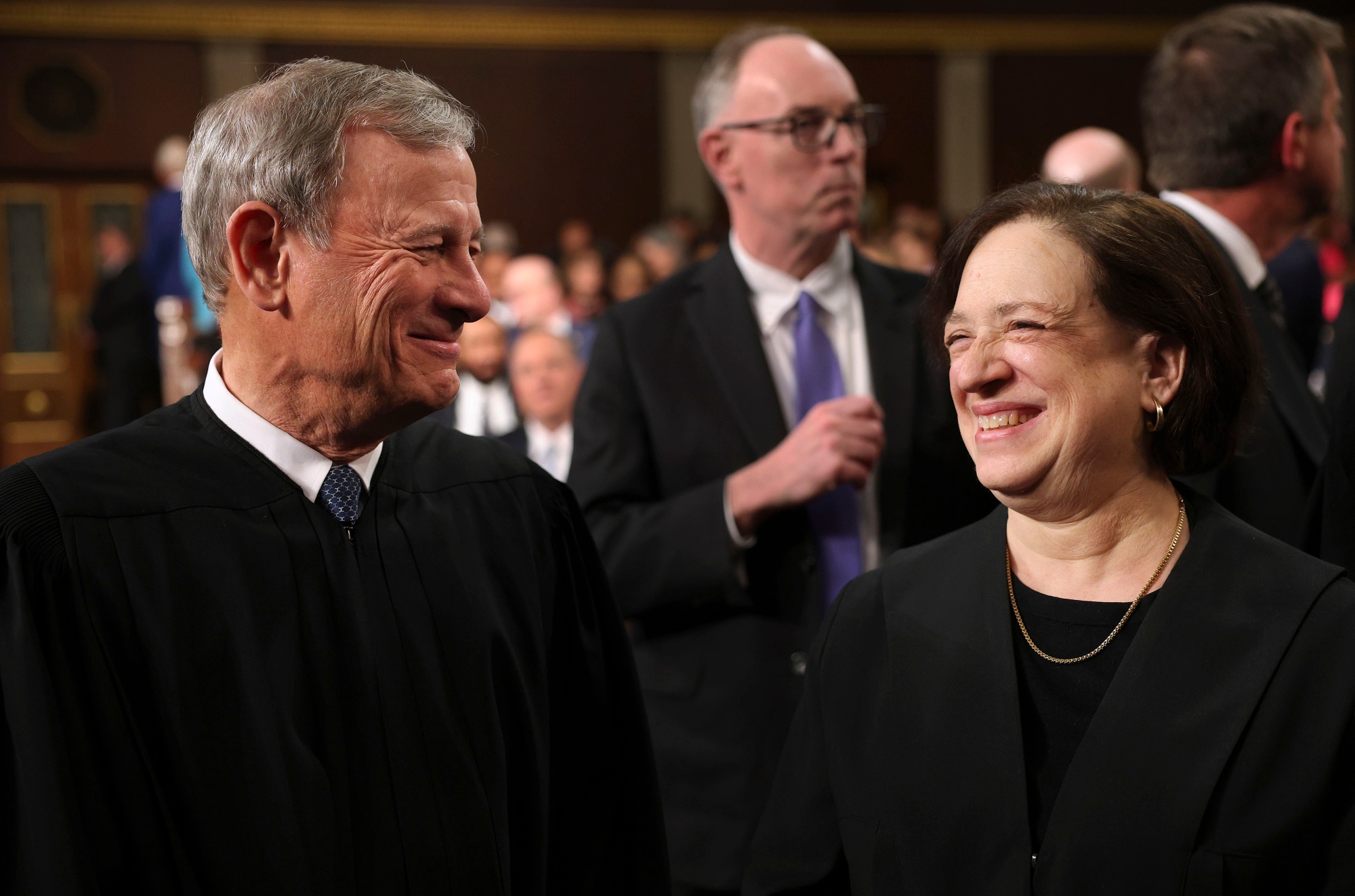

| The six Republican appointees who dominate the US Supreme Court appeared ready Monday to take a huge step in consolidating more American power around one person, the president, at the expense of Congress. Under the leadership of Chief Justice John Roberts, who since his days as a lawyer in Ronald Reagan’s Justice Department has held a robust view of executive prerogative, the supermajority telegraphed its intent to potentially give Donald Trump control over dozens of independent federal agencies. In doing so, the court could partially or wholly reverse a 90-year-old precedent that Roberts and proponents of the “unitary executive theory” have long had in their sights. It would be the latest in a series of moves by the court to limit or overrule existing case law in favor of legal interpretations that follow GOP priorities on everything from voting rights and deregulation to firearms and reproductive freedom. In this case, a ruling in favor of Trump also would fulfill one of the aims of Project 2025, the far-right manifesto co-authored by some members of the current administration.  Chief Justice John Roberts, left, and Associate Justice Elena Kagan Photographer: Win McNamee/Getty Images During oral arguments today, the justices suggested they will let Trump permanently remove Rebecca Kelly Slaughter from the Federal Trade Commission despite laws passed by Congress that say commissioners can be fired only for specified reasons. Slaughter’s ouster would leave the consumer-protection agency without any Democratic commissioners. The high court’s three Democratic appointees attacked the administration’s support for expanding the executive branch’s remit. Associate Justice Elena Kagan concluded it would mean “massive, uncontrolled, unchecked power in the hands of the president.” —David E. Rovella and Natasha Solo-Lyons | |

What You Need to Know Today | |

| Paramount Skydance launched a hostile takeover bid for Warner Bros. Discovery at $30 a share in cash on Monday, just days after the company agreed to a deal with Netflix. The offer values Warner Bros. at $108.4 billion, including debt. The bid compares with Netflix’s offer of $27.75 in cash and stock. Paramount’s offer is for all of Warner Bros., while Netflix is interested only in the Hollywood studios, HBO and the streaming business. Warner Bros. investors “deserve an opportunity to consider our superior all-cash offer for their shares in the entire company,” Paramount Chief Executive Officer David Ellison said in a statement. Ellison is the son of Oracle chief Larry Ellison, a major Trump donor. His hostile bid—which as it turns out has some help from Trump son-in-law Jared Kushner—comes just as Trump is making noises about a potential “problem” with the Netflix deal. | |

|

| |

| |

|

| Ripple’s $500 million share sale in November drew some of Wall Street’s biggest names and marked a milestone in crypto’s evolution from fringe asset class to mainstream finance. Investors including Citadel Securities and Fortress Investment Group backed the firm at a $40 billion valuation, a record for a privately held digital-asset company. But the structure of the deal also highlights the careful approach some institutional investors are taking as they wade deeper into the volatile sector. It included crucial protections: the right to sell shares back to Ripple at a guaranteed return and preferential treatment should a major event like a bankruptcy or sale occur. | |

|

| |

|

| PepsiCo announced a series of operational changes backed by activist investor Elliott Investment Management on Monday, including a review of its supply chain and slashing its overall number of products. The company is also planning employee terminations in North America, according to an internal memo. The moves, which include the removal of nearly 20% of its US product lineup, will “accelerate organic revenue growth, deliver record productivity savings and improve core operating margin—starting in 2026,” Chief Executive Officer Ramon Laguarta said in a statement. | |

|

| Apple chip chief Johny Srouji, whose potential departure risked worsening a bout of executive turnover, told staff on Monday that he’ll stay at the iPhone maker for now. “I know you’ve been reading all kind of rumors and speculations about my future at Apple, and I feel that you need to hear from me directly,” he said in a memo to his division. “I love my team, and I love my job at Apple, and I don’t plan on leaving anytime soon.” Bloomberg News reported over the weekend that Srouji had discussed leaving the company, indicating that he might work for a different technology firm.  Johny Srouji Photographer: Gabby Jones/Bloomberg | |

|

| |

What You’ll Need to Know Tomorrow | |

| |

| |

| |

| Enjoying Evening Briefing Americas? Get more news and analysis with our regional editions for Asia and Europe. Check out these newsletters, too: Explore all newsletters at Bloomberg.com. | |

| |

Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. Want to sponsor this newsletter? Get in touch here. | | | You received this message because you are subscribed to Bloomberg's Evening Briefing Americas newsletter. If a friend forwarded you this message, sign up here to get it in your inbox. | | |